Quarter in Review

Financial Markets Continue to Recover

Stock and bond markets generated gains for a second consecutive quarter amid resilient economic growth and moderating inflationary pressures.

- The S&P 500 Index rose by 7.5% in the first quarter of 2023. Stock prices were buoyed by a surprisinglyresilient economy as the job market remains strong and U.S. consumers remain in a healthy financial position.

- Bond markets also produced outsized gains with the Bloomberg U.S. Aggregate Bond Index rising by 3%during the quarter. Bond prices recovered as interest rates declined amid moderating inflationary pressuresand hopes that the Federal Reserve may be nearing the end of its interest rate hiking campaign.

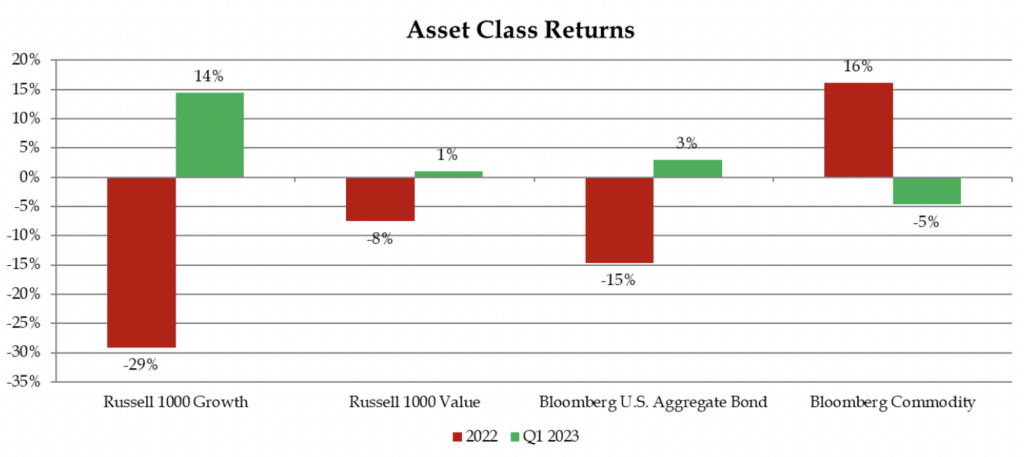

A Notable Reversal in Market Dynamics from 2022 to Q1 2023

2022 was a historically challenging year for investors as stock and bond markets declined in tandem leaving investors few places to hide. The first quarter of 2023 provided investors a reprieve as both stock and bond markets recovered and most asset classes generating gains.

There was also a marked shift in underlying trends within markets during the quarter. 2022 was notable for the strong outperformance of value stocks, which had meaningfully underperformed growth stocks for most of the past decade. The first quarter of 2023 saw growth stocks re-emerge as top performers while value stocks lagged behind. Further, commodities, which was one of the only asset classes to generate gains in 2022, was one of the few asset classes to decline in value in the first quarter of this year.

This notable change in market dynamics is likely explained by a shift in the narrative driving financial markets. In 2022, investors were primarily focused on inflation and rising interest rates, which translated to broad-based declines in asset prices in response to a sharp tightening in financial conditions. Investors have shifted their focus in 2023 to moderating inflation and expectations for the Federal Reserve to pause on its monetary tightening campaign, which has led to declining interest rates and broad-based gains in asset prices as financial conditions have eased.

Investment Outlook

Mounting Recession Signals Suggest Caution Still Warranted

Our investment outlook remains cautious despite the recovery in financial markets in Q1 2023 and continued resilience in the economy. Despite the recent reprieve in financial markets, we believe the risk of recession has materially risen in the wake of the sharp tightening of financial conditions engineered by the Federal Reserve and other central banks around the world over the past year. There are also key indicators that have historically proven prescient in signaling recession that are flashing caution.

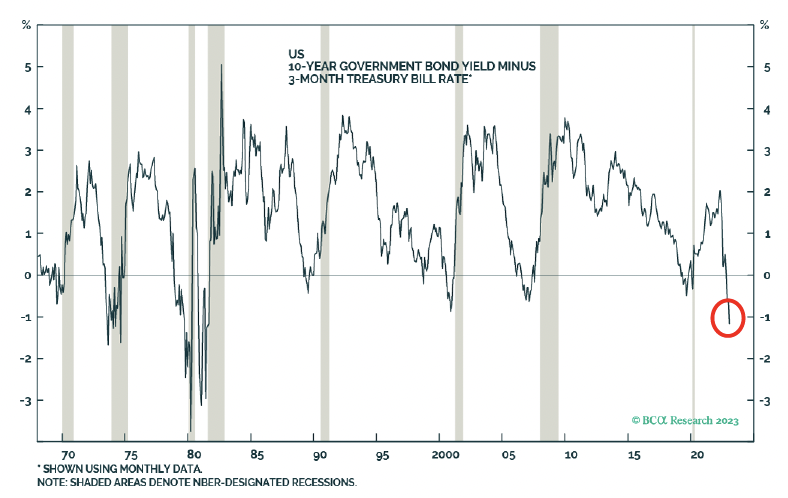

Inverted Yield Curve

An inverted yield curve is an uncommon phenomenon where short-term interest rates are higher than long-term interest rates. Historically, this has been one of the more reliable recession indicators as it suggests the bond market is concerned about the economy slowing in the future.

The U.S. Treasury yield curve is currently the most inverted it has been in 40 years (see chart below).

Banking Sector Turmoil

The financial headlines were abuzz in March with news of the failures of Silicon Valley Bank and Signature Bank. These were the largest bank failures since the financial crisis of 2008 and the first signal of cracks in the banking system amid the sharp tightening in financial conditions over the past year. While we do not believe these events will ultimately prove a precursor to another financial crisis, they do signal that there are potential issues in the plumbing of the financial system from rising interest rates and reduced liquidity. This is another cautionary signal for future economic growth as banks are likely to reduce lending in response to the recent turmoil.

Pressure on Corporate Profits & Margins

Through the pandemic and the economic upheaval wrought by it in recent years, corporate profits have remained remarkably strong as businesses have been adept at managing costs and navigating uncertainty to continue profitably growing. This trend continued last year as the stock market declines were mostly driven by reduced valuations from rising interest rates as opposed to declining profits. However, we are beginning to see cracks in corporate profits and profit margins as the accumulated pressures from the pandemic, inflation, and rising interest rates are finally beginning to take a toll.

Perspective for Investors

While our outlook is cautious based on the indicators discussed above, these signals are not foolproof and have not proven reliable in predicting the timing of past recessions. Current conditions suggest the economy remains strong as the job market is growing, the U.S. consumer is healthy, and the housing market has remained surprisingly resilient despite the sharp rise in mortgage rates. We anticipate economic conditions will likely begin to deteriorate over the balance of the year as the impact of the monetary policy tightening is more acutely felt. As always, we will be closely monitoring economic and financial market data for clearer signals on the path forward for the economy and markets.

For investors, we continue to promote maintaining discipline and a long-term perspective. Investing is an endeavor defined by uncertainty as financial markets attempt to price what investors believe is most likely to transpire in an unpredictable future. We continue to advocate that investors focus on the following guiding principles:

- Stay Diversified

- A foundational principle to managing risk amid uncertainty

- Focus on Resilience in Portfolios

- Emphasize investments in companies with strong balance sheets and consistent cash flows

- Communicate with Your Financial Advisor

- Ensure your financial plan remains a living plan and the focal point of your investment strategy

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and

Registered Investment Advisor. This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.