Year in Review

2020 was, to say the least, an unusual year, and investors were along for the ride. Against a backdrop of a global pandemic, widespread economic shutdowns, and record unemployment, the S&P 500 endured its fastest fall ever into a bear market in March, only to rise to its all-time high by year-end. To say it was a year of extremes may be an understatement. While there will be much to digest about 2020 in the years to come, let’s review some of the key storylines for investors during a turbulent year:

- The stock market is NOT the economy The disconnect between the stock market and the underlying economy was perhaps the major story for investors in the latter half of 2020 and is a topic we have discussed before in our quarterly letters. When markets sold off dramatically in March, investor pessimism was matched by a dramatic economic contraction and record unemployment. But by April, investors had begun to regain faith in equities, and the S&P 500 recovered its pre-pandemic high a few months later. While it is true that underlying economic data started to improve over the summer and through the fall, many questioned why markets were responding so positively to such a middling improvement in data. A partial answer is that markets are forward-looking, and so arguably investors were looking through to hopes of a full economic recovery on the horizon. Another clue is that the sectors that make up the economy do not share the same weight in major stock indices. For instance, the technology sector comprises only 6% of nominal GDP but makes up 38% of the S&P 500 ( Bureau of Economic Analysis), a fact that reminds us of one of the other major stories for investors in 2021.

- Narrow markets were a BIG story: A major story for investors in 2020 was the narrowness of the stock market recovery, which was driven largely by huge gains in technology stocks. The S&P 500 ended the year up a little over 18%(total return), but technology companies within the index gained 44% during the year. Consumer discretionary and communication services stocks were not far behind. All of these sectors are considered “growth” sectors. Meanwhile, traditional “value” sectors in the index lagged their growth counterparts for the year, and some, like financials and energy, even ended the year down. The outperformance of growth-style equities was also a theme for the several years leading into 2020, leaving value-style investors in the cold for a while. Since value stocks tend to be more heavily represented in cyclical economic sectors, historically they have lagged during the later stages of economic expansions and during recessions like we experienced leading into and during the first quarter of 2020. Instead, they tend to outperform in the early stages of an economic recovery following a recession. Thus, many market watchers were expecting value stocks to pull ahead of growth stocks as the recovery began in the late spring. While these stocks did begin to make up ground at the very end of the year, the continued dominance of growth stocks through the opening stages of the recovery was unexpected for many investors.

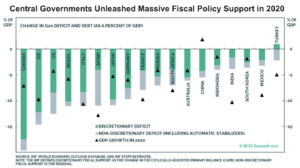

- Monetary and fiscal policy worked in unison: We can’t end a recap of 2020 without discussing the massive and, yes, unprecedented monetary and fiscal policy actions taken to steady the effects of the global economic shutdown. In March, as bond market liquidity disappeared and financial markets reeled, the Federal Reserve Bank waded in and executed its playbook from 2008 to another order of magnitude. It quickly cut short-term interest rates to 0%, enacted large-scale asset purchases, and established swap lines for international partners to access much-needed U.S. dollars. It also for the first time ever purchased not just government bonds but bonds issued by corporations, as well, in an attempt to steady markets. The Fed’s speedy monetary policy response helped restore trading functionality to bond markets, and its policies were mirrored by most major central banks around the world. But it wasn’t monetary policy alone that helped restore confidence to markets. Indeed, the bigger story here may be the coordination of fiscal and monetary policy this time around. In many cases, central banks specifically called on their governments to support their actions with fiscal easing, and this call was heeded. In March, the U.S. federal government passed the CARES Act, a $2.2 trillion fiscal stimulus package, and many other countries likewise supported their own monetary easing with a weighty fiscal response. The U.S. followed up with another large stimulus package at year-end. The twin easing from monetary and fiscal policy gave global markets a steady tailwind for the remainder of 2020 and should still help bolster the economy moving forward.

Year Ahead

While we can re-cap some of the major themes from 2020, assessing the aftermath of such a momentous year will likely take decades. In the meantime, we can posit some important questions that investors will likely face over the next twelve months:

- How will the economic recovery play out? 2021 will likely be the year during which we can begin to assess the full extent of the damage caused by the global (and in many cases ongoing) economic shutdown. While some parts of the economy, such as retail sales and housing, have already shown a strong rebound from spring 2020 lows, other data from the job market and service sector have shown only modest improvements. What’s more, the improvements we saw during the summer and fall seemingly stalled at year-end, with the Citi Economic Surprise Index declining in December. This year, it will be critical for investors to see sustained and broad-based improvement in economic activity, especially in the job market and service sector, which makes up the majority of U.S. GDP (Bureau of Economic Analysis). While the stock market isn’t the economy, the two are certainly related. The assumption until now has been that the economy will indeed make a full recovery, bolstered by the twin pillars of monetary and fiscal easing alongside pent-up demand from consumers with untapped savings to spend. If data emerges that threatens this rosy outlook, such as a delay in vaccine distribution or a longer than expected return to economic normalcy, investors may become skittish.

- Will stock market leadership broaden or even rotate? While, as we have so recently and thoroughly learned, anything can happen, investors are entering 2021 largely bullish on stocks. As discussed above, 2020 was a banner year for growth stocks, especially in the technology sector. Meanwhile, other parts of the stock market languished; value stocks largely did not make up their March losses until the last months of 2020, when they began to surge. A major question this year will be: can value stocks sustain their recent momentum and finally make up for years’ worth lost ground? Indeed, traditional value sectors like financials, energy, and industrials have historically done well during economic recoveries. Data indicating a sustained and robust economic recovery would likely favor these styles. On the other hand, the most recent economic data shows growth slowing due to the latest round of pandemic-induced shutdowns. If the economy endures another slowdown, it could be hard for value stocks to outperform, and growth stocks may stay in favor yet longer. Another theme to consider in 2021 and beyond could be a resurgence in developed international and emerging market equities. The U.S. dollar has shown recent signs of weakness. If this persists and becomes a trend, it may favor international stocks in the year ahead.

- How will the effects of monetary and fiscal stimulus play out? As we discussed above, the coordinated policy response in 2020 from central banks and central governments to ease financial conditions was massive in scale. As the year develops, investors will likely be evaluating whether the policy response was too much, just right, or not enough. Financial conditions that are too easy could cause a spike in inflation. Given the Fed’s commitment to keeping short-term interest rates near 0%, it may be hard for them to combat inflation using traditional methods (i.e. an interest rate hike). Therefore, an unexpected inflationary scare could be difficult for investors to digest and could roil stock and bond markets. On the other hand, if growth stalls and it becomes clear that more easing is needed, the Fed is theoretically constrained by a zero lower-bound on interest rates. It would likely have to use other unconventional tools, like increased asset purchases or yield curve control, to provide a monetary boost. In an extreme case, we could even see asset purchases extend to more corporate debt and even equities, as has been done in countries like Japan. The Fed would also likely call on the federal government again to provide additional easing in the form of stimulus or infrastructure spending. While the story is not resolved one way or the other yet, measuring the effects of the massive easing and monitoring further policy actions will certainly be a major theme for investors in 2021.

Closing Thoughts

While the outlook for the global economy and capital markets has improved markedly since the shock of the pandemic-induced recession a year ago, the future remains uncertain with the vaccine roll-out just beginning and many consumers and businesses still struggling to recover. We continue to call for investors to position for what may lie ahead by maintaining discipline around a long-term financial plan, staying diversified in their investment portfolios, and avoiding short-term, emotionally-driven investment decisions.

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.