BIG NUMBER | 13.2%

The Wheat and the Chaff

Identifying investment opportunities may take a sharper focus going forward.

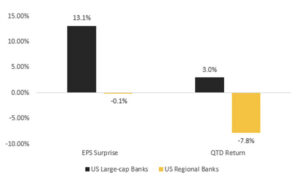

Fears about banks’ financial health have dominated many investors’ thoughts for weeks. But as we make our way through first-quarter earnings season, it’s clear that some of those banks are feeling fine while others need a shot in the arm—a fact that has important investment implications. Specifically, as seen in the chart below, the largest U.S. banks have exceeded analysts’ first-quarter earnings expectations by more than 13% on average. In a stark contrast, smaller regional banks have delivered earnings results thus far that were just slightly below expectations—resulting in a gap between big and regional banks of 13.2%.

Source: Bloomberg as of 04/26/23

Those upside surprises have pushed shares of the big banks higher this month (3%)—while investors have punished the regionals (-7.8%), despite those banks’ results essentially living up to analyst predictions. The level of surprise at the big banks’ earnings signifies that many investors have been painting the banking sector as a whole with too broad a brush. Large-cap banks appear to be in a relatively strong position in a few key areas:

- While additional regulatory scrutiny may be challenging for regional banks, the big banks are already meeting these requirements and will likely be minimally impacted by heightened regulatory efforts.

- Big banks saw positive deposit flows at the expense of regional banks during the first quarter—attracting depositors’ savings as they fled the regionals.

- Regional banks lowered their earnings guidance on the expectation of needing to pay higher deposit rates to attract capital.

Here’s why that’s important. As we near the end of the Fed’s rate hike cycle, this is a reminder that a more micro focus on investing in the current environment may be prudent. All banks are not in the same boat, and valuable nuances exist within broad asset classes, sectors, and other areas of the financial markets. Drilling down to identify risks on a more granular level will be increasingly important.

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor. This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance does not guarantee future results. Materials above are produced by Horizon Investments, LLC, which is not affiliated with the advisory firm identified on the front page. © 2023 Horizon Investments, LLC.