Year in Review

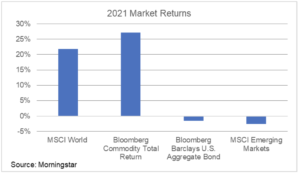

2021 was another good year for most areas of capital markets, which were spurred on by an economic recovery that has been faster and stronger than anticipated. Global stock markets, as measured by the MSCI World Index, increased by 21% this past year, building upon a 16% gain in 2020. Commodity prices also appreciated sharply in 2021; demand increased amid the strong bounce-back in economic activity, while supply struggled to keep pace, especially in energy markets.

However, there were some notable areas of weakness in capital markets last year. Fixed income markets were challenged, with the benchmark Bloomberg Barclays Aggregate Bond index modestly declining in 2021 in response to rising interest rates and accelerating inflationary pressures. Emerging market stock and bond indices also struggled, largely due to weakness in China, which was beset by challenges in its real estate market and by an unexpectedly harsh regulatory crackdown on key companies, most notably in the technology sector.

The following are two of the key trends that we believe impacted markets in 2021:

- A Banner Year for Corporate Earnings:

Pent-up demand from the pandemic-induced shutdowns in 2020, healthy consumer balance sheets, and continued government stimulus led to strong growth in the global economy last year. The robust economic recovery translated into historic growth in corporate earnings. Earnings of S&P 500 companies are expected to have grown by 45% in 2021, which would represent the highest annual growth rate since FactSet began tracking the data in 2008. In our view, the strength in company earnings was the single most important factor behind the outsized gains in stock markets last year.

- Inflation Returns with a Vengeance:

After over a decade of subdued inflation, consumers experienced an unexpectedly sharp acceleration in price increases in 2021. The Consumer Price Index (CPI) rose by 6.8% year-over-year in November, which is the highest inflation rate since 1982 (Bureau of Labor Statistics). A combination of bottlenecks disrupting global supply chains and historically strong consumer demand for goods contributed to the sharp rise in consumer prices. One area that experienced some of sharpest price increases was the energy market, with oil prices up nearly 60% over the past year (U.S. Energy Information Administration). The unexpectedly and persistently strong increase in inflation over the past year pressured bond prices and was a key factor impacting fixed income markets.

2022 – Positive Outlook but Headwinds on the Horizon

Our outlook for the global economy and capital markets is constructive heading into 2022. Consumer balance sheets remain healthy, the job market is strong, and monetary policy is still accommodative. These factors should continue supporting the economy and financial markets in the new year.

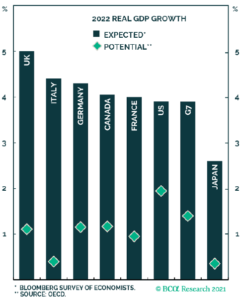

As shown in the chart below, economic growth is expected to be robust in 2022, with key developed countries likely to grow well above their trend level of growth over the past decade.

Despite this positive backdrop, there are important transitions underway in the economy and capital markets that could prove more challenging for investors as the year unfolds.

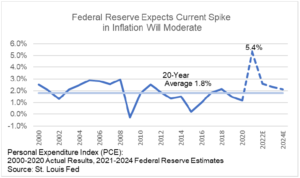

- Inflation – Transitory or Structural?

There is much debate on the level of inflation and whether the current level will prove transitory, as initially hoped, or more structural in nature. The transitory case remains that inflation is temporarily elevated due to pandemic-related factors, such as supply-chain bottlenecks and elevated demand for consumer goods, and will abate over time.However, Federal Reserve (Fed) Chair Powell recently commented that “transitory” is no longer an appropriate way to describe the inflation we are experiencing. If inflation proves to be more entrenched, it may force the Fed and other global central banks to tighten monetary policy more quickly than expected, which could prove disruptive to financial markets.

- Monetary and Fiscal Policy Set to Become Less Supportive:

With the economy back on solid ground and inflationary pressures rising, central banks, led by the Fed, are starting to remove some of the accommodative policies enacted to support markets and the economy over the past two years. The Fed began tapering its bond purchase program in November and is currently planning to raise short-term interest rates three times in 2022. This is a much faster pace of monetary tightening than the Fed and markets were expecting last year and suggests the Fed is growing more concerned about inflation. While these moves would still leave monetary policy broadly accommodative in an absolute sense, we will be closely watching how markets respond and whether the Fed decides to tighten policy even more aggressively in response to inflation.Further, government spending is set to decline in 2022 from the historic levels of fiscal stimulus we saw over the last two years in response to the pandemic. While this is likely to prove a drag on economic growth in the near term, we believe it is an important long-term development as the global economy continues to recover from the COVID-induced shock of recent years. We will be closely monitoring the impact of reduced government spending to gauge the resilience and durability of the economic recovery that has taken hold over the past 18 months.

Closing Thoughts

We believe the ongoing recovery in global economic activity and continued strength in corporate earnings will remain supportive of capital markets in 2022. However, we will be closely monitoring the above-mentioned focal points, namely inflation and the transition to less accommodative monetary and fiscal policies, to discern if a more cautious investment outlook may become warranted as the year progresses.

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.