U.S. Economy in Growth Slowing Phase of Cycle

The economy saw a boost in real GDP growth during the second quarter, driven largely by an increase in business investment. While consumer spending did moderate somewhat, it still maintained a solid pace overall. Additionally, there were some indications that residential investment may be starting to stabilize. Despite the tight labor market, inflation actually fell during this time period.

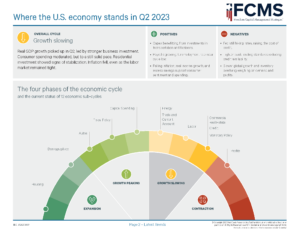

OVERALL CYCLE

Growth Slowing

Real GDP growth picked up in Q2, led by stronger business investment. Consumer spending moderated, but to a still solid pace. Residential investment showed signs of stabilization. Inflation fell, even as the labor market remained tight.

POSITIVES

- Capex benefitting from investments in transportation and factories.

- Payrolls growing. Unemployment rate near cycle low.

- Falling inflation, real income growth, and excess savings support consumer sentiment and spending.

NEGATIVES

- Fed still hiking rates, raising the cost of credit.

- Tighter bank lending standards reducing credit availability.

- Slower global growth and inventory overhang weighing on demand and profits.

You can review the full Quarterly Market Dashboard by clicking here.

To receive weekly updates from the FCMS Investment Committee, please subscribe to our blog and follow us on our social media channels for the latest information.

To learn more about FCMS Investment Management, please click here.

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC (FFS). Member FINRA, SIPC and Registered Investment Advisor. The commentary in this report is not a complete analysis of every material fact in respect to any company, industry, or security. This material contains the opinions of the author(s) but not necessarily those of FFS, and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and do not constitute a solicitation to buy or sell any security or product and may not be relied upon in connection with the purchase or sale of any security or device. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in any index. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance does not guarantee future results. Materials above are produced by Horizon Investments, LLC, which is not affiliated with FFS. © 2022 Horizon Investments, LLC.