First Quarter in Review

2021 began on a hopeful note: mass vaccines were on the way, the economy was beginning to reopen, and there was every expectation for a continued monetary and fiscal response to the pandemic. Three months in, many of those hopes are well on their way to being fulfilled, especially in the U.S., where approximately a third of the population has received at least one dose of COVID vaccine and where trillions of dollars of additional spending in direct stimulus and infrastructure are likely imminent. The result has been concrete progress in the global economic recovery, particularly around some of the metrics we consider the most critical to a strong recovery:

- Employment: The March unemployment number was 6%, down from nearly 15% last April. Other good news on the employment front was an above-consensus increase in payrolls in March, with a large portion of job creation going to leisure and hospitality, one of the areas hit hardest by the COVID shutdowns. Likewise, job openings are the highest they have been since January 2019 (Bureau of Labor Statistics).

- Economic Surprises: The Citigroup Global Economic Surprise Index continued to climb higher during the first quarter, indicating that economic data releases are consistently coming in stronger than consensus expectations. This is a sign that a robust global economic recovery is indeed underway.

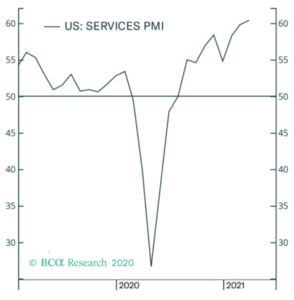

- Services: While manufacturing was well on the way to recovery at the end of 2020, the service sector, which makes up the majority of U.S. economic activity, continued to lag. The first quarter, however, brought marked improvement to the U.S. Services PMI, which is now at its highest level since July 2014 (IHS Markit). Combined with growing employment in the service sector, this improvement is a very hopeful sign for the U.S. economy.

The unexpected strength and speed of the recovery have had a concerted impact on global capital markets. Global stock markets have made an awe-inspiring recovery from last spring’s lows, while safe-haven assets like U.S. Treasuries have begun to sell off. While investors would expect to see stocks outperform bonds during an economic recovery, the speed and scale of the market action are remarkable and speak to the speed and scale of the recovery itself, both realized and expected. Interestingly, the first quarter brought a reversal in several long-standing trends that further hint at growing investor confidence:

- Beginning in the fourth quarter of 2020, small cap stocks began to surge ahead, meaningfully outperforming their large cap counterparts. Likewise, in the first quarter of 2021, we saw significant outperformance in value stocks, particularly in cyclical sectors like financials and energy. This reversed a long-standing trend of markets being led higher by U.S. large cap growth, especially technology, stocks and is a sign that market participants are buying into the broadening economic recovery story.

- Speaking of U.S. large cap growth stocks, they were one of the worst performing market segments in the first quarter, eking out only meager gains. Technology stocks, which have been seen as a defensive play amid the pandemic, struggled in a sign that investors see better value elsewhere. This again speaks to a reversal of trends in the market.

- As mentioned above, the first quarter brought a sell-off in the highest quality segments of bond markets; indeed, according to data from Bloomberg, the first quarter of 2021 was the worst quarter for U.S. Treasuries since 1980. This sell-off was a reversal of the “flight to safety” that we saw over much of the past year and indicates that investors are hopeful about the prospects for economic growth. As interest rates rose during the quarter in response to rising growth and inflation expectations, bond prices declined. If the economic recovery continues as expected, this is a trend that could easily continue, potentially causing more pain for bond investors and buoying stock markets.

Investment Outlook

While the first quarter was largely a hopeful one for the economy and stock markets, there are still unresolved issues for investors as the year progresses. Below are some of the questions that will likely face investors as 2021 continues:

- How sustainable is the economic recovery?While the pace and magnitude of the economic recovery have so far surpassed expectations, it will be important to see if the recovery continues and if it is ultimately sustained. In the U.S., one of the key dynamics to watch in the near term will be around consumer demand. Data indicates pent-up demand for services and a build-up in household savings. If these savings are used to satisfy demand once the economy more fully reopens, it could help further accelerate economic growth in the second half of this year. Another key measure to watch is unemployment. If we continue to see good news on the employment front like that discussed above, it may indicate a more sustained recovery. Perhaps most important to remember, though, is the extent to which the economic recovery has been boosted by fiscal and monetary stimulus. In the medium- to long-term, it will be important to evaluate if the recovery can be sustained without the continued emergency support measures of governments and central banks.

- Is inflation on the horizon? Much ink has been spilled in the last quarter about the prospects for inflation returning in the U.S. given the amount of fiscal and monetary stimulus that have been pumped into the economy. It is no wonder that investors are paying attention: inflation has the potential to further derail bond markets and to negatively impact equity investors. On the immediate horizon, we expect at least a temporary rise in inflation late this spring amid a recovering economy, but i n the medium- and long-term, there are likely to be both inflationary and deflationary forces at work in the economy. Inflationary forces include the massive amounts of government spending and stimulus alongside significant support from the Federal Reserve, which is maintaining short-term interest rates near 0% and continuing to provide liquidity to capital markets through asset purchases. Deflationary forces include unprecedented debt levels and the potential for tax increases, both of which could constrain economic activity, and the possibility for a structural reduction in economic potential due to reduced labor force participation and pandemic-related business closures. Either way, the long-term outlook for inflation remains uncertain.

- What can bond investors do? Bond investors got a glimpse last quarter of what rising interest rates can do to their portfolios; as mentioned above, U.S. Treasury bonds endured their worst quarter in 40 years. If the economy continues to recover or if inflation ticks up, bond markets could be in for more pain. Making things even more challenging for bond investors, despite the recent rise in rates, interest rates are still near historical lows. This makes earning income in bond portfolios a challenge. To earn income and offset interest rate risk, bond investors may need to look at alternative income-producing asset classes such as preferred stocks, convertible bonds, high-yield bonds and emerging market debt or consider an increased allocation to equities. The caveat: reaching out for yield can meaningfully increase portfolio risk. Investors will need to balance their desire for yield and potential increased reward with the concomitant increased risk.

Closing Thoughts

The outlook for the global economy and capital markets has improved markedly since the shock of the pandemic-induced recession a year ago. The recovery to date has been awe-inspiring in terms of both speed and magnitude, and there is seemingly good reason for the growing sense of optimism among investors. That said, there are still important risks on the horizon, including the sustainability of the economic recovery and the potential for inflationary pressures, that call for continued vigilance. We recommend that investors maintain discipline around a long-term financial plan, stay diversified in their investment portfolios, and avoid short-term, emotionally-driven investment decisions.

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.