First Quarter in Review

The first quarter of 2022 was a challenging one for investors. Traditional asset classes like stocks and bonds broadly posted losses (indeed, bond markets suffered one of their worst quarters on record). On the other hand, it was a banner period for commodities, which had one of their best quarterly returns ever. While it may be convenient to view geopolitical tensions as the primary driver of market activity in the first quarter, many of the market trends that started the year were merely exacerbated by the onset of the Russian invasion of Ukraine mid-way through the period. Here follows a breakdown of what happened across capital markets:

- Equity Markets

Most major stock indices ended the quarter down (see chart). The selloff started in January when markets were initially driven down by prospects for higher interest rates and higher inflation. Indeed, some major stock indices reached “correction” territory, defined as a loss of 10% or more from recent highs, during the first half of the quarter (the NASDAQ, composed primarily of large cap tech stocks, posted a correction on January 19; the S&P 500 on February 23). Stock markets suffered a further blow with the Russian invasion of Ukraine on February 24. Markets initially sold off more on fears that the Russia/Ukraine crisis and the resulting sanctions might slow economic growth and lead inflation even higher for even longer. After the initial shock, though, most markets, including those that had been in correction territory, recovered from their intra-quarter lows. In fact, U.S. and developed international markets posted gains in March, likely on hopes that initial fears about slowing growth and out-of-control inflation were overblown.

- Fixed Income Markets

The combination of high inflation and looming interest rate hikes by several important global central banks led to one of the worst quarters on record for bonds. U.S. investment grade bonds, as measured by the Bloomberg U.S. Aggregate Bond index, lost almost 6%, a surprising outcome for what is considered to be amongst the most conservative of asset classes (see chart). The dynamics make sense, even if the magnitude of losses was higher than what market participants expected. Interest paid on existing bonds becomes less attractive as inflation increases, so holders often sell them in response. Further, the prices of existing bonds typically go down as interest rates increase, since investors favor newly issued bonds paying higher rates of interest. Several central banks, perhaps most importantly the U.S. Federal Reserve Bank (Fed), broadcasted early in the year that they expected to raise interest rates as the quarter progressed. Indeed, the Fed did raise interest rates by 0.25% in March, the first rate hike since the beginning of 2019. With six to eight more rate hikes from the Fed expected in 2022, the challenging dynamics in bond markets may not reverse in the near future. - Commodities

Conversely to stocks and bonds, commodities, an asset class comprised of investments in oil, gas, metals, agricultural products, and other basic materials, boasted one of their best quarters on record. The Bloomberg Commodity Index gained a staggering 25.55% (see chart). This asset class tends to do well in inflationary environments and was posting strong performance even before the Russia/Ukraine crisis, which provided a further boost. The Russian economy is primarily connected to other global economies as a commodity producer; Russia’s role in providing natural gas to Europe and wheat to emerging nations has been much discussed in recent weeks. Russia is also a key exporter of palladium, used in catalytic converters, and fertilizer ingredients. The prospect of an ongoing conflict and sanctions increased worries of constrained supplies over a longer time horizon and led to sharp rises in commodity prices during the quarter. Like the sell-off in bonds, it is hard to say when and if this trend might slow or reverse.

Investment Outlook

After a challenging first quarter for many investors, the critical question seems to be “where do we go from here?”. Some of the trends that drove markets in the first quarter are likely to linger, but there are also some positive fundamentals to consider. Though the outlook is certainly mixed, the overall picture for markets may not be as bleak as investors fear. We suggest a framework for considering the economic and market outlook:

Markets often look through geopolitical crises, but other effects may lingernflation – Transitory or Structural?

The Geopolitical crises usually have a short-lived effect on markets. However, it is still unclear what the long-term effects of an extended Russia/Ukraine conflict could be on capital markets. A drawn-out conflict could have continued consequences for markets due to Russia’s position in the global supply chain and ongoing economic sanctions. These effects might be particularly challenging for Europe, which relies heavily on Russian oil and gas exports. Overall, markets seem to be viewing the conflict as inflationary, which could put more downward pressure on bond prices and upward pressure on commodity prices.

Monetary policy and inflation are key factors to watch

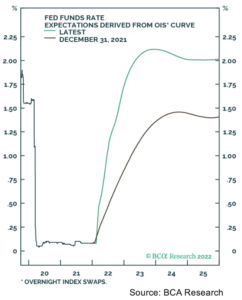

It’s important to remember that markets were struggling even before February 24, particularly in the U.S., driven to a large extent by the recent pronounced shift in Federal Reserve policy expectations. In 2022, the Fed has shifted its focus from supporting the economy and markets in response to the pandemic to fighting inflation. This policy shift has substantial repercussions for financial markets, as the Fed now plans to aggressively raise interest rates and reduce the size of its balance sheet faster and more significantly than anticipated just a few months ago (see chart). And while rising interest rates aren’t necessarily a death knell for equity markets, the most important question for investors for the remainder of the year is whether the Fed can engineer a “soft landing” that allows the U.S. economy to continue growing despite tightening financial conditions designed to battle inflation.

But, not all bad news!

While markets seemed to process a lot of bad news in the first quarter, it is important to remember that a lot is also going right for the U.S. economy at the moment. Unemployment is close to an all-time low, job openings are robust, and household balance sheets are strong. We have also seen that many companies are able to pass through rising costs to consumers to some extent, which should help preserve earnings and profit margins. Indeed, not a lot of indicators are flashing red for U.S. recession in the next twelve months, and it is rare to have a sustained bear market outside of a recession. The combination of first quarter losses, high inflation, and geopolitical tensions stoked by the Russian invasion of Ukraine have potentially led investors to have a too-pessimistic view of the economy and markets, and conditions could be right for any positive surprises to lead markets higher.

Closing Thoughts

Uncertainty around the geopolitical situation, interest rates, and inflation will likely persist for the foreseeable future and may lead to continued market volatility. What, then, can investors do to help weather the situation? For one, don’t try to time the market. History shows that investors are poor market timers and that trying to sell assets at the peak or buy at the bottom is usually a losing game. Secondly, stay diversified. It can be tempting to “chase returns” by seeking to invest in only those investments that have recently been the strongest performers (e.g. technology stocks in the late 1990s). However, history has shown that a diversified portfolio has resulted in a more consistent journey for investors over time and has helped to reduce risk. Finally, stay focused on your long-term financial plan and avoid making short-term decisions driven by fear. Investing can be a challenging endeavor that requires enduring short-term pain to reap long-term reward, and historically gains in positive years for markets have outweighed the drag caused by negative years, allowing long-term, disciplined investors to grow their investments over time.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.

1 The Bloomberg U.S. Aggregate Bond Index had its worst quarter since Q3 1980.

2The equal-weighted Reuters Continuous Commodity Total Return Index jumped 27.0%, it’s best quarter since data began in 1956.