Market Review & Outlook

U.S. stock markets lay an egg in the first quarter

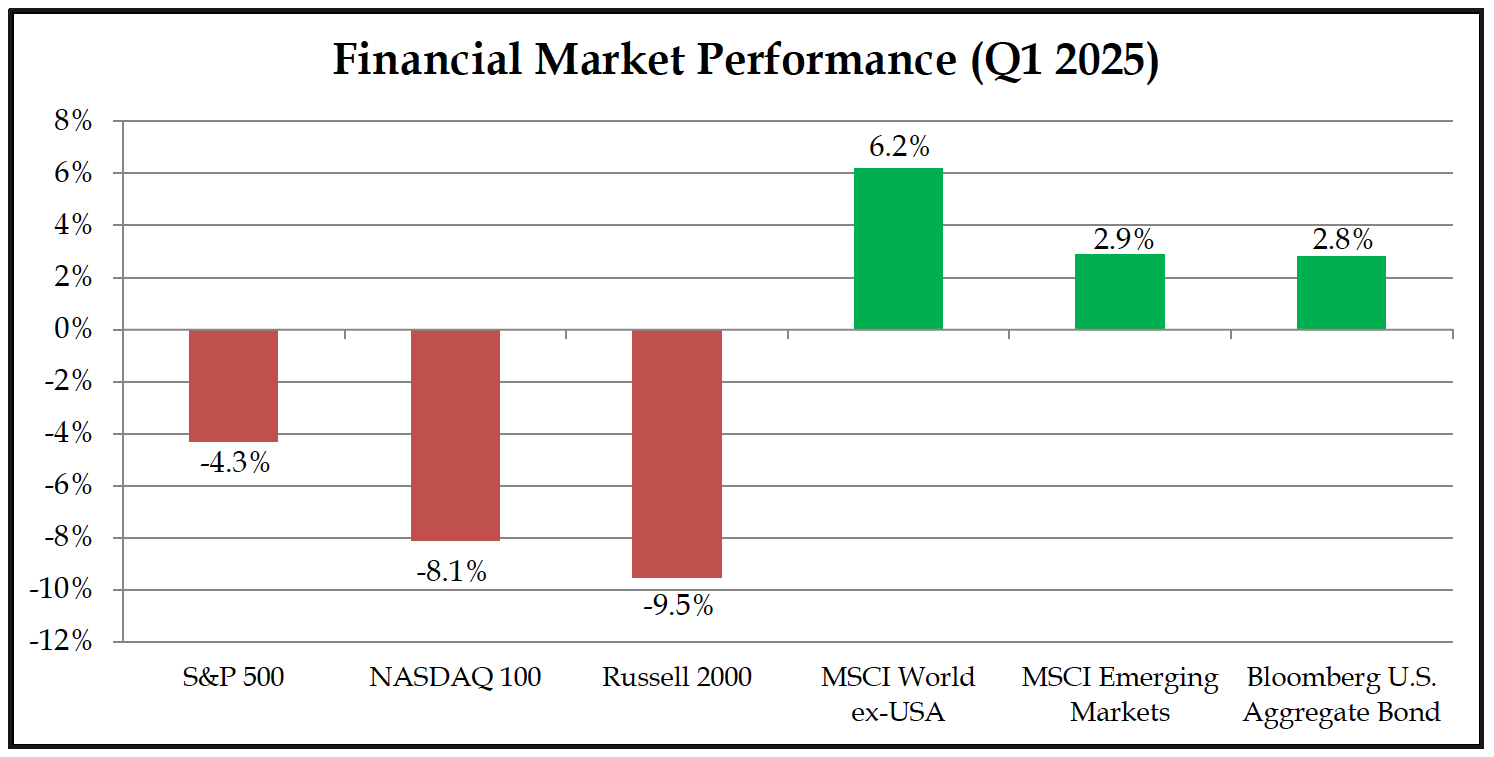

U.S. stock market investors entered 2025 optimistic after two years of 20%+ returns for the S&P 500, expecting strong gains to continue and broaden in 2025 due to President Trump’s seemingly business-friendly policy plans (i.e., tax cuts and deregulation). Unfortunately, these optimistic expectations fell through as U.S. stock markets suffered their worst quarter since 2022, with the S&P 500 declining -4.3%, the technology-heavy NASDAQ 100 falling -8.1%, and small caps stocks, represented by the Russell 2000 index, declining -9.5%. There was nowhere to hide for domestic stock market investors in the first quarter. Additionally, at the time of this writing in early April, the U.S. stock market sell-off has gathered significant momentum with the NASDAQ 100 entering a bear market (meaning a 20% decline from its recent peak) and the S&P 500 nearing this point, too. In contrast, international stock markets broadly had a positive first quarter, which is discussed in more detail below.

What caused the disconnect between U.S. investors’ lofty expectations entering 2025 and disappointing results so far?

- First and foremost, President Trump’s aggressive policy agenda has triggered a sharp rise in uncertainty, especially surrounding disruptive tariff policies and geopolitical overtures seemingly intent on radically changing the global world order that has been in place for a generation. Markets were caught off guard by the President prioritizing the more disruptive elements of his policy agenda for the economy and markets, while focusing less on the more market-friendly policies of tax cuts and deregulation.

- Alongside the policy-induced rise in uncertainty, U.S. economic growth has shown recent signs of decelerating, albeit from strong levels, leading to renewed concerns about recession risk. Worries aboutinflation also resurfaced among consumers and businesses amid tariff-induced uncertainty and scarsfrom the sharp rise in price levels just a couple of years ago.

Long-maligned international stocks shine despite turbulence in U.S. stock markets

Investors had seemingly given up on the prospects for international stocks after 15 years of lackluster results and expectations for additional challenges from President Trump’s America-first policy agenda. Seemingly out of nowhere, international developed and emerging equity market indices generated strong gains and handily outperformed their U.S. counterparts in Q1 with the MSCI World ex-USA index rising 6.2% and the MSCI Emerging Markets index gaining 2.9%.

Developed markets were buoyed by Europe where political developments in Germany led to a dramatic shift in policy with legislation passed to significantly increase government spending on defense and infrastructure, leading to higher growth expectations in Germany and Europe more broadly.

Emerging markets were led higher by China where technology stocks rose sharply higher in the wake of the DeepSeek AI announcement in January that challenged the market consensus that U.S. technology companies had already won the AI race.

Bonds return to their traditional role as a safe haven in volatile times

Bond investors have grown weary in recent years after suffering historic losses in 2022 and struggling to regain ground ever since. However, amid the market turmoil in the first quarter, bonds returned to their traditional role of providing ballast to investor portfolios during turbulent times. The benchmark Bloomberg U.S. Aggregate Bond index rose 2.8% as interest rates declined in response to rising uncertainty and concerns about the economic outlook. Historically safe U.S. Treasuries also outperformed high-yield corporate bonds as credit spreads widened in response to investor concerns about rising risks to the economic outlook.

Investment Outlook

In our annual letter in January we wrote:

“There is still much to be determined regarding which policy proposals are prioritized, when and how they will be implemented, and the ultimate impact they will have on the economy and financial markets. While the trajectory of markets in 2025 is unknown, we believe the uncertainty surrounding the potential impact of the policy proposals of the Trump administration combined with an elevated level of investor optimism calls for increased prudence.”

The investment landscape has shifted dramatically since we wrote this three months ago. With the investor sentiment pendulum now having swung sharply from optimism to pessimism in response to President Trump’s tariff announcements and the uncertainty surrounding them, what should investors be watching going forward?

Will the sharp decline in survey measures of consumer and business sentiment (“soft data”) translate to weakness in consumer spending and corporate earnings (“hard data”)?

Surveys of consumer and business sentiment regarding the economic outlook have plummeted amid elevated economic uncertainty and financial market volatility. To date, the weakness in these “soft data” measures has not led to broader weakness in economic activity with consumer spending, the job market, and corporate earnings remaining resilient. The big question for investors is whether the increasingly pessimistic views among consumers and businesses will eventually lead to a slowdown in consumer spending and business investment that ultimately tip the U.S. economy into recession.

What does the Federal Reserve (Fed) do next?

One of the key reasons investors entered 2025 optimistic was in response to the Fed finally beginning to loosen monetary policy in late 2024 with a series of interest rate cuts and expectations that the policy easing would continue this year. However, the Fed has paused their interest rate cutting campaign in 2025 in response to stubbornly elevated inflation and concerns about the potential impact of tariffs on the inflation outlook. A less accommodative Fed has the potential to cause further indigestion for financial markets.

WHAT’S AN INVESTOR TO DO IN THESE UNCERTAIN TIMES?

Forecasting economic and market outcomes is notoriously difficult and unreliable, and it is often more helpful to use history to instruct our outlook and actions. While the temptation of assuming this time is different has often led investors to allow emotions to dictate their short-term investment decisions, history has consistently demonstrated the long-term detriment of doing so.

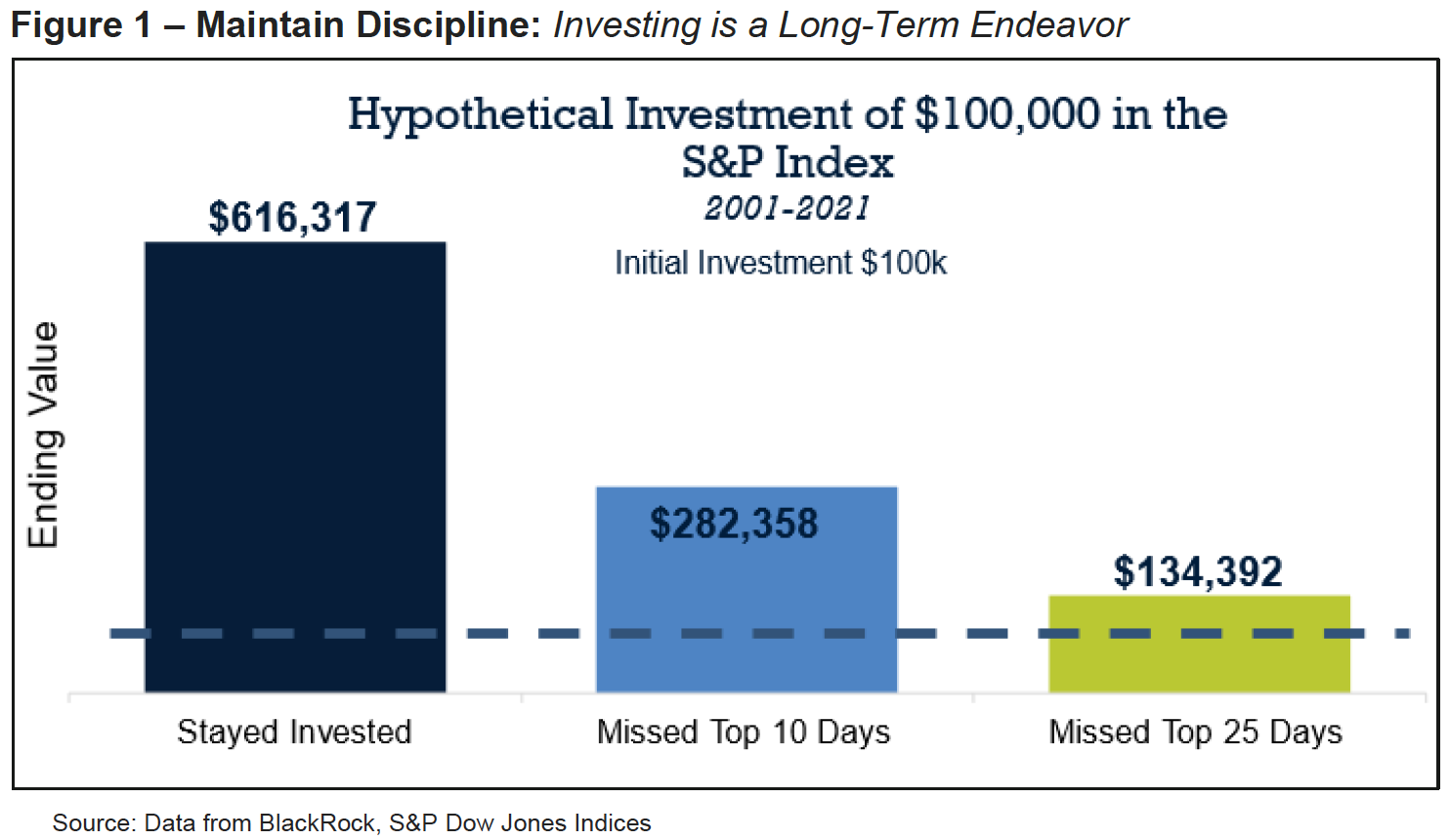

- Maintain Discipline & Avoid the Temptation to Time Markets – History shows that investors are poor market timers and that trying to sell assets at the peak or buy at the bottom is usually a losing game. History has also shown that gains in positive years for markets have outweighed the drag caused by negative years, allowing long-term, disciplined investors to grow their investments over time. See Figure 1 below.

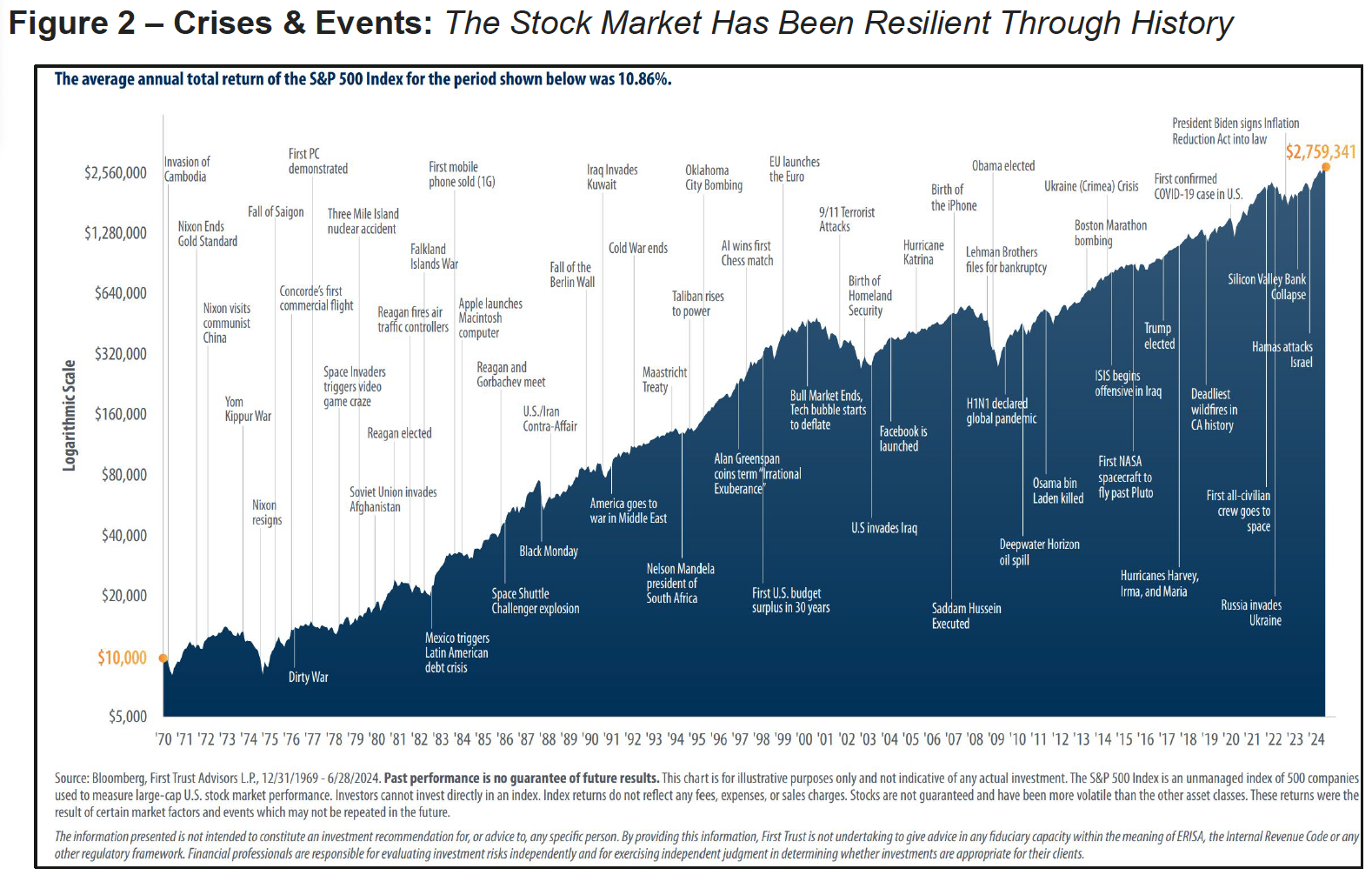

- Don’t Let Short-Term Emotions Disrupt Your Long-Term Plan – Although the current environment is fraught with uncertainty for investors, the stock market has continued to grow over the long term despite countless crises and unexpected events over the course of time. While history does not repeat, it does often rhyme. See Figure 2 overleaf.

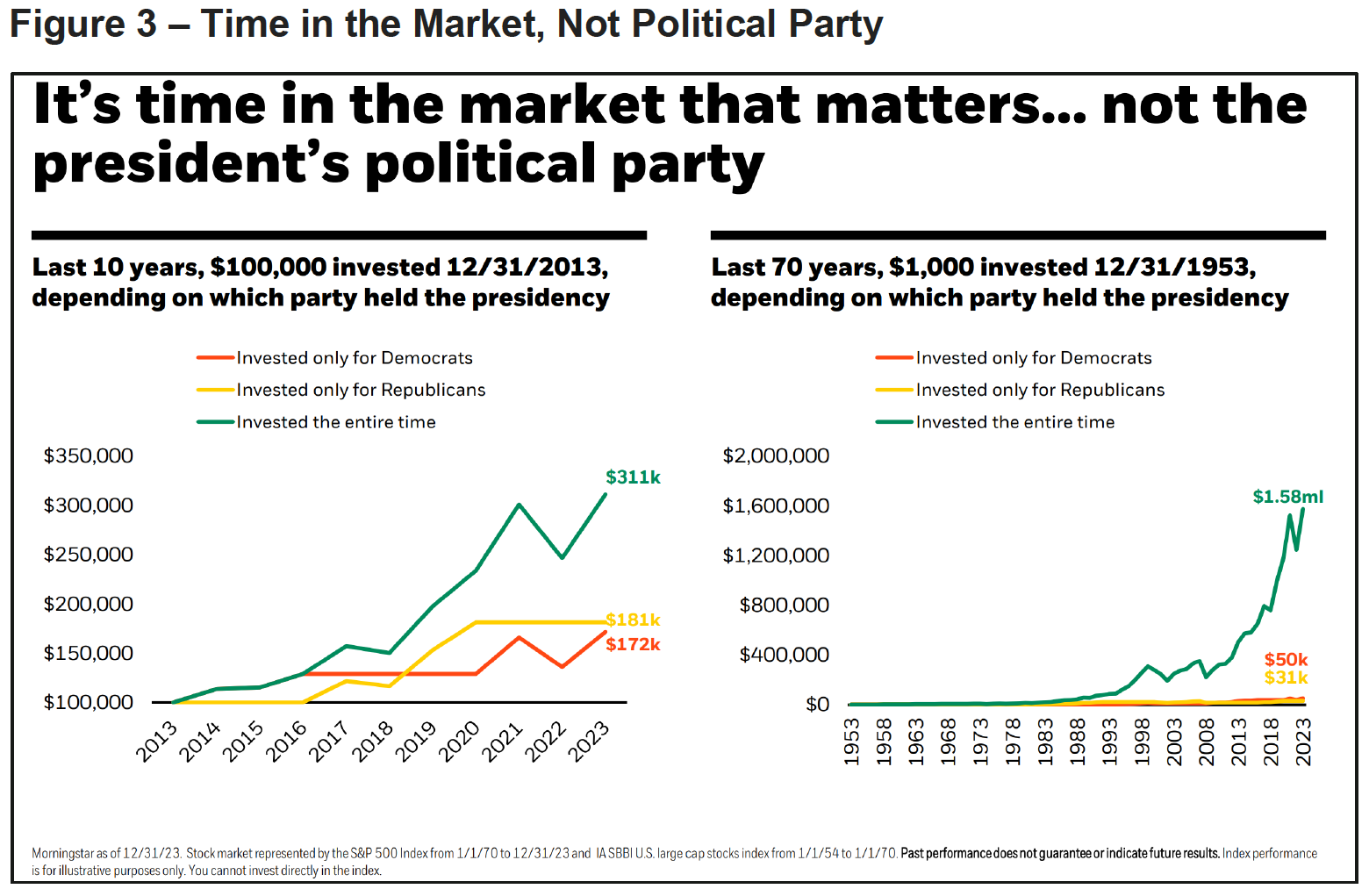

- Don’t Let Politics Drive Your Investment Decisions – It’s time in the market, not the president’s political party, that matters over the long term. See Figure 3 overleaf.

Finally, engage with your financial advisor and stay focused on your long-term financial plan. During periods of heightened uncertainty, it is critical to avoid making short-term decisions driven by fear. Investing can be a challenging endeavor that requires enduring temporary pain to reap long-term reward.

Discover more from the FCMS Investment Committee by subscribing to our Founders Insights blog and following us on LinkedIn.

Authored by the Freedom Capital Management Strategies® Investment Team | January 2025

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Past performance does not guarantee future results.