Year in Review

2022: A Year to Forget for Investors

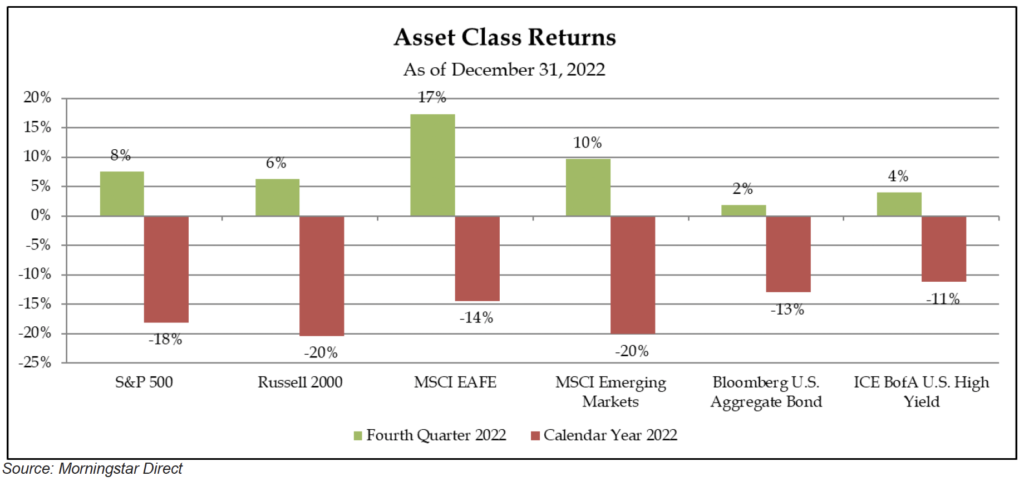

Stock and bond markets staged a recovery in the final quarter of last year, but it was not nearly enough to offset the significant financial market declines from the first three quarters of 2022. Much will likely be written in the years to come about the historic challenges investors confronted in 2022 with both stock and bond markets around the world experiencing double digit percentage declines.

What made 2022 such an extraordinarily difficult year for investors was the unusual combination of historic declines in bond markets alongside the worst year for global stock markets since the Great Recession of 2008. In fact, the benchmark Bloomberg U.S. Aggregate Bond Index’s 13% decline in 2022 was its worst calendar year performance by a wide margin, dating back to the index’s inception in 1976. Last year shattered the long-standing expectations of investors that bond holdings would soften the blow of declines in stock holdings in diversified portfolios during periods of financial market volatility. In 2022, growth-oriented equity investors and conservative fixed income investors alike were beset by significant declines in portfolio values.

What Made 2022 Such a Challenging Year for Investors?

We believe the fundamental cause of the turbulence experienced by investors last year was a dramatic and unexpected regime change in the economy and financial markets.

Since recovering from the Great Recession of 2008, the economic and financial market environment had generally been characterized by the following:

- Low and stable consumer price inflation

- Highly accommodative monetary policy (low interest rates and abundant liquidity)

- Steadily rising asset prices

In 2022, these core factors changed 180 degrees, which left investors reeling and markets struggling to recalibrate amid such a dramatic and rapid shift in underlying fundamentals. Last year was characterized by:

- Unexpectedly high and rising consumer price inflation

- Significant tightening in monetary policy (higher interest rates and reduced liquidity)

- Sharp declines in asset prices

What Caused Such a Rapid and Pronounced Regime Shift in the Economy and Markets?

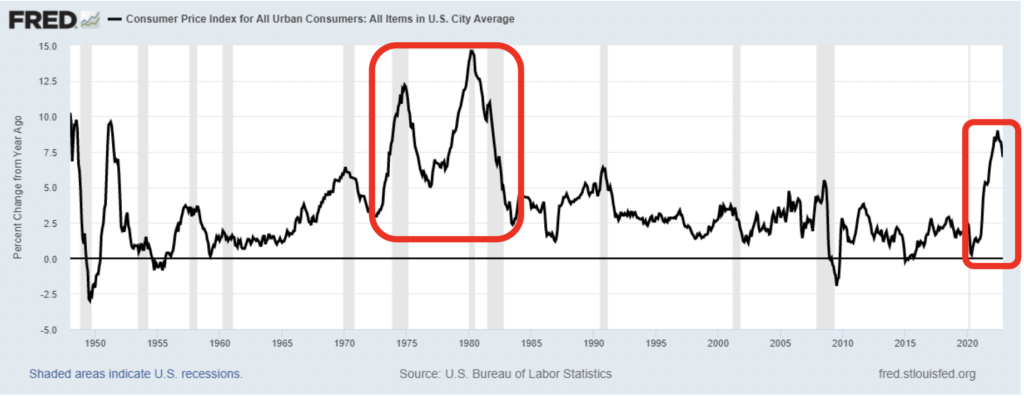

In a word…INFLATION. Consumers and businesses were beset by the most intense pressure from rising prices in over forty years, and central banks responded forcefully by sharply increasing interest rates and removing liquidity from financial markets.

A toxic combination of demand-driven and supply-side factors in the wake of the pandemic caused last year’s sharp rise in consumer price inflation.

On the demand side, inflation was pulled higher by the following pandemic-induced factors:

- Historic amounts of fiscal and monetary stimulus left consumers and investors flush with cash

- Pent-up demand from consumers as the economy reopened after large scale shutdowns

- Dramatic changes in consumer demand patterns with an initial sharp rise in demand for goods alongside collapsing demand for services followed by the reversal of this trend that is currently underway amid the economic reopening

On the supply side, inflation was pushed higher by the following factors:

- Reduced labor force participation and an imbalanced job market

- Supply chain bottlenecks in the production and distribution of goods and services

In summary, the unexpectedly persistent rise in consumer price inflation last year led to a surprisingly sharp tightening of monetary policy from central banks and precipitated unprecedented financial market turbulence.

Amid these historically challenging dynamics facing investors, what is the outlook for the economy and financial markets as we begin 2023?

Investment Outlook

2023: A Cautious Outlook with Glimmers of Opportunity for Investors

Our overall investment outlook remains cautious as we enter 2023 because risk and uncertainty are elevated. While the regime shift described earlier most meaningfully impacted financial markets last year, it is not yet clear the impact these dynamics, namely high inflation and tighter monetary policy, will ultimately have on the economy.

The current consensus among investors seems to be that economic growth is set to slow markedly in response to this regime change and that recession is a foregone conclusion in 2023. However, we believe there is much yet to be determined regarding the path of the economy this year as changes in monetary policy have historically impacted the economy with long and variable lags.

On the one hand, we agree that recession risk is elevated as key leading indicators, most notably an inverted yield curve driven by a sharp tightening in monetary policy, suggest recession is likely in the not-too-distant future based on historical precedent. We are also beginning to see a slowdown in key interest rate-sensitive sectors of the economy, such as housing, and expectations for corporate earnings have begun to decline. Consumer and business sentiment also remain in the doldrums based on many survey measures, which is likely to prove a headwind to growth through a potential slowdown in consumer spending and business investment.

On the other hand, there are budding reasons for optimism despite widespread pessimism among investors. Most importantly, the rate of consumer prices inflation has finally begun to decelerate, and the direction of inflation will likely be more important than the level of inflation for financial markets going forward. The job market has also demonstrated surprising resilience despite the challenging economic backdrop as job openings remain elevated and the unemployment rate remains near historic lows. Finally, China has recently abandoned its zero-COVID policy, which is likely to unleash a surge of pent-up demand in the world’s second largest economy.

Perspectives for Investors

Times like these are trying for investors as financial markets are in turmoil and pessimism has gained the upper hand. However, times of widespread market gloom, like today, have often preceded periods of significant opportunity for investors who remain disciplined and focused. We encourage investors to focus on the following core principles:

- Maintain Discipline: Investing is a long-term endeavor – don’t try to time markets

- Stay Diversified: Focus on building resilience in your investment portfolio

- Communicate with Your Financial Advisor: Ensure your financial plan remains a living plan and the focal point of your investment strategy

It is during volatile periods that maintaining a long-term investment perspective and staying focused on your financial plan are most important. We believe that by adhering to these core disciplines you will be in a stronger position to capitalize on the opportunities created from recent market turbulence and to ultimately staying on the path to achieving your financial goals and dreams.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.