Market Review & Outlook

U.S. stock markets prove exceptional, again.

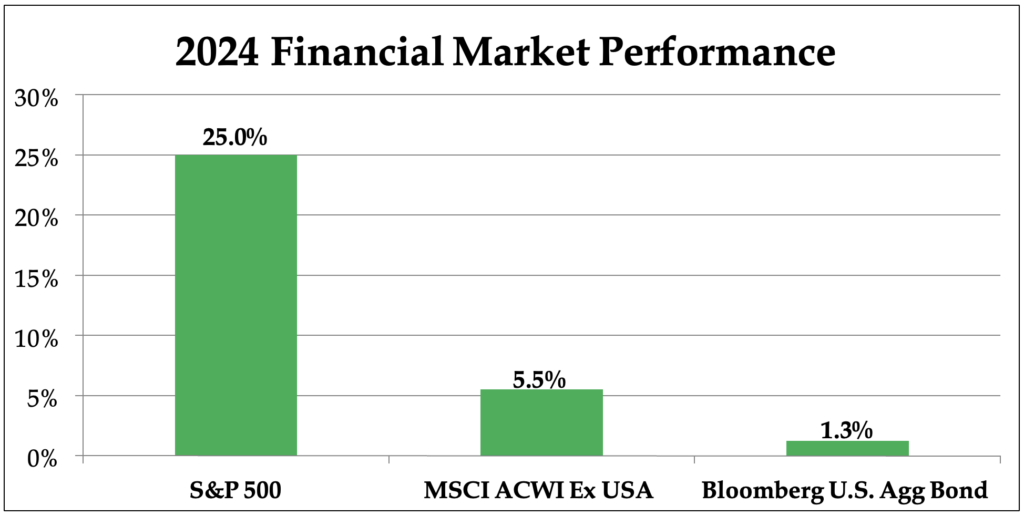

The benchmark S&P 500 index rose 2.4% in the fourth quarter and extended its gains to 25% for the full year. The strength in U.S. stock markets last year meaningfully surpassed even the most optimistic forecasts from market prognosticators a year ago. 2024 was the second consecutive year in which the S&P 500 rose by more than 20%, which is an infrequent occurrence that last happened in the late 1990s.

U.S. equities were buoyed in 2024 by a strong economy and moderating inflation. The U.S. economy has proven surprisingly resilient in recent years and has been a beacon of strength globally. A robust job market has supported U.S. consumers who have been the engine of U.S. economic growth. Inflation also moderated meaningfully last year, allowing the Federal Reserve (Fed) to begin cutting interest rates, which also benefitted U.S. stock markets.

International stock markets fail to impress, yet again.

It was a less rosy picture for international equity markets last year, which once again meaningfully lagged their U.S. counterparts. This has been a pronounced trend over the past 15 years that seems unlikely to reverse course in the near term with fundamental weakness oversees and the strong momentum in the U.S. economy described above.

Europe and China are the two largest economies behind the U.S. globally and both have been struggling of late. Europe has been beset by slow growth resulting from weak demographic and productivity trends and seemingly lacks the economic dynamism of the U.S. China has been ailing from a deflating property market bubble similar to what the U.S. experienced during its financial crisis over 15 years ago. With both Europe and China struggling while the U.S. economy has been strong, it is no surprise that international equity markets have continued to underwhelm.

Bond markets continue to languish.

Bond markets continue to languish.

Bond investors entered 2024 optimistic with the expectation that declining interest rates would finally awaken bond markets from their multi-year malaise. However, the hope for a sharp decline in interest rates proved premature as the Fed cut shortterm interest rates by much less than expected and long-term interest rates, as measured by the 10-year U.S. Treasury bond yield, actually increased on the year. The result was a paltry gain of 1.25% for the benchmark Bloomberg U.S. Aggregate Bond index, which paled in comparison to the exceptional gains in U.S. stock markets.

Investment Outlook

U.S. investors are entering 2025 with a high level of optimism, but they will likely need to navigate some changes in the new year with President Trump’s return to the White House.

Optimism is elevated among U.S. investors, which has set a high bar for the economy and markets in 2025.

It is no surprise that U.S. investors are generally quite optimistic at the outset of the new year. The U.S. economy is strong with robust growth, low unemployment, and moderating inflation. U.S. stock markets have also delivered exceptional gains of late.

As usual, great results come with great expectations, and investors are expecting a lot from U.S. stocks in 2025.

- Corporate earnings expected to be exceptional

According to FactSet, the consensus forecast is for S&P 500 companies to collectively grow their earnings by 15% in 2025. This is nearly double the average rate of earnings growth over the past 10 years and has set a high bar for U.S. companies. - U.S. stocks are richly valued

By most measures, the S&P 500 is historically expensive, suggesting that a lot of good news is being priced into markets. For example, the S&P 500 currently trades for nearly 22x forward earnings. This is well above the 17x forward earnings that the index has averaged over the past 30 years (J.P. Morgan Asset Management).

Elevated optimism alone does not indicate that stocks markets are set for an imminent decline. However, it has historically been a signal that risk levels have risen for investors and that markets are not currently focused on (or priced to reflect) potential risks on the horizon.

Change is on the horizon with President Trump’s return to the White House, and the impact on the economy and markets remains a key question for investors in 2025.

Markets initially reacted to President Trump’s re-election by following the playbook of what worked for investors during his first term – U.S. stock markets gained, international stock markets declined, and bond markets declined as interest rates rose. However, the state of the U.S. economy today is markedly different than in 2017 (the beginning of Trump’s first term).

- Today, U.S. economic growth is strong, interest rates are relatively high, and we have recently emerged from a multi-year period of high inflation.

- In 2017, U.S. economic growth was weak, interest rates were low, and inflation was low and stable.

The key question for investors is how the expected policy changes of Trump 2.0 will affect the economy and markets considering the state of the economy today compared to 8 years ago.

- An optimistic perspective is that his proposals for deregulation and tax cuts will lead to an acceleration in economic growth through improved productivity by reducing red tape and increasing business confidence and investment.

- A pessimistic perspective is that his proposed changes to trade and immigration policies will disrupt the flow of goods, services, and labor leading to another wave of inflation, which combined with the expected expansion in the fiscal deficit based on his policy proposals could lead to a sharp increase in interest rates.

There is still much to be determined regarding which policy proposals are prioritized, when and how they will be implemented, and the ultimate impact they will have on the economy and financial markets. While the trajectory of markets in 2025 is unknown, we believe the uncertainty surrounding the potential impact of the policy proposals of the Trump administration combined with the elevated level of investor optimism discussed above calls for increased prudence.

As always, we encourage investors to stay focused on their long-term plans by remaining disciplined, staying diversified, and engaging with their financial advisors.

Discover more from the FCMS Investment Committee by subscribing to our Founders Insights blog and following us on LinkedIn.

Authored by the Freedom Capital Management Strategies® Investment Team | January 2025

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Past performance does not guarantee future results.

Bond markets continue to languish.

Bond markets continue to languish.