Second Quarter in Review

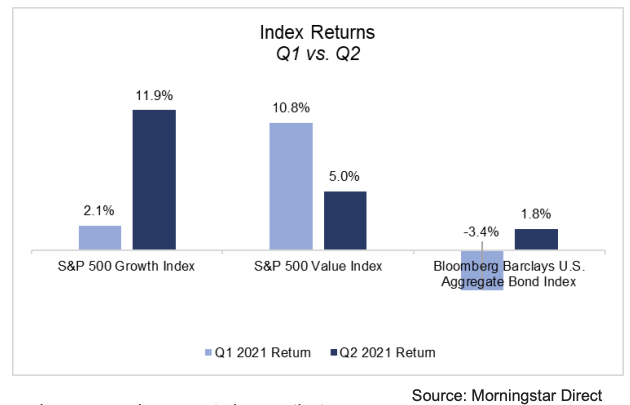

Overall, stock and bond markets gained during the second quarter, continuing the rally investors have enjoyed for over a year. Underneath the surface, however, some interesting dynamics were at work in capital markets. The second quarter of 2021 saw a reversal of several key market trends from quarter one. During the first quarter, markets broadly reflected the “recovery trade”: asset classes that are typically attractive during periods of strong economic growth, such as value stocks and high-yield corporate bonds, surged ahead, while U.S. Treasury bonds and other safe-haven assets struggled. These dynamics reflected a “risk-on” sentiment from investors, who largely seemed encouraged by the faster-than-expected pace of the economic recovery. In the second quarter, however, these market dynamics reversed as asset classes that typically benefit from slower economic growth and lower interest rates, such as large-cap growth stocks and U.S. Treasury bonds, posted strong performance, while value stocks and riskier parts of the bond market were less favored.

This change in sentiment seemingly represented a pause as investors digested several key, and often competing, macroeconomic developments:

- The pace of recovery slowed: While the economy still has strong momentum, the pace of the recovery has slowed from the breakneck speed of its earliest stages. Notably, positive economic surprises have slowed, meaning that fewer economic data releases are surprising to the upside than in prior quarters. Employment data, which the Federal Reserve has flagged as a critical measure of economic healing, continues to improve but still has a lot of room to recover to reach pre-pandemic levels. Finally, service industries, which make up the majority of U.S. economic activity and were hit hardest by the COVID shutdowns, are still struggling to bounce back fully. Taken together, while the economy is still improving, it is improving at a slower rate, and it appears to be transitioning from early recovery conditions to a slower-paced, more sustained recovery.

- Inflation heating up: There was much talk about inflation during the second quarter, as supply chain bottlenecks spurred breathtaking price increases in some segments (for instance, lumber prices more than tripled from pre-pandemic prices1 ). Broad-based annual inflation also outpaced the Federal Reserve’s target of 2%, driven particularly by rising energy prices.2 Some of the rise in inflation was driven by base effects, since last year’s consumer price data was unusually weak amid the pandemic. However, it remains unclear just how transitory the pick-up in inflation will be. Investors seemed to take uncertainty around the trajectory of inflation as an invitation to unexpectedly pare back some of the sharp increases in long-term interest rates that had occurred in the first quarter as they questioned whether rising inflation would ultimately lead to slower growth.

- The Federal Reserve (Fed) talked tightening: Following the June Federal Open Market Committee meeting, Chair Jerome Powell characterized the meeting as “talking-about-talking-about” monetary tightening in the form of tapering bond purchases. Fed projections from that meeting also showed consensus on a rate hike in 2023. Investors took both of these developments as hawkish surprises from the Fed, indicating that monetary policy may become tighter more quickly than originally projected. Tighter monetary conditions tend to put the brakes on economic growth, and capital markets may have gotten the jitters from the hawkish Fed chatter, especially in relation to the durability of the “recovery trade”.

Investment Outlook

While we still see economic conditions as broadly positive and expect the global recovery to continue, questions remain about the pace of the recovery moving forward, the potential for inflation, and upcoming policy decisions. These factors will help determine whether the “recovery trade” will regain momentum or if asset classes that benefit from slower economic growth and stable inflation will reassert their leadership, as they did in the second quarter. Alternately, a more volatile and less investor-friendly market regime could take hold. Whichever the outcome, the outlook for markets does seem more variable and uncertain than it was for the first half of the year.

- Economic Recovery: As discussed above, the pace of economic growth has slowed from extraordinary to merely strong over the last quarter. Investors will be watching the trajectory of growth in the coming months. Evidence that the economic recovery still has room to run, such as meaningful gains in employment, further improvement in service sector data, and continued fiscal stimulus, might give investors more confidence in the “recovery trade”. Conversely, a more rapid deceleration in the pace of growth with a less robust jobs and service sector outlook could disappoint investors and drive them to asset classes perceived as less risky.

- Inflation: With even the Federal Reserve revising its inflation forecast upward, investors should be buoyed by any signs that inflationary pressures are in fact cooling, such as a resolution of supply chain bottlenecks or a sustained slow-down in year-over-year inflation numbers. Low and stable inflation has been a key factor driving the strong gains in stock and bond markets over much of the past decade. As such, a sustained rise in inflation to undesirable levels could prove destabilizing to capital markets.

- Monetary Policy: Investors have made it clear that they don’t care for surprises from the Federal Reserve in terms of language or policy. Clearly communicated, predictable, and “dovish” policy actions from the Fed are what investors have come to expect, and the tone of Fed communications will likely remain critical in determining the sustainability of the stock market recovery. If inflationary pressures force the Fed to tighten policy more quickly than currently anticipated, the favorable market backdrop could deteriorate quickly.

Closing Thoughts

There are currently competing and interconnected forces at work in the economy and capital markets that may result in more challenging conditions for investors going forward, especially considering elevated valuations resulting from the historic market recovery over the past year. On one hand, continued strong economic growth may be good for stock markets, but its ultimate effect could be to spur higher-than-desired inflation and rising interest rates. This in turn would likely pressure the economy and markets. On the other hand, a slower recovery could disappoint investors’ rosy growth expectations but could also reduce inflationary pressures, allowing the Fed to continue providing significant monetary support. Such a circumstance would likely buoy markets. Either way, the trajectory of these factors and their interaction with one another is uncertain, and we will be monitoring economic data and market movements closely for signals in the coming months. Meanwhile, the prudent course for investors is to maintain discipline around a long-term financial plan; stay diversified in their investment portfolios; and avoid short-term, emotionally-driven investment decisions.

Sources

1 Fastmarkets Random Lengths Framing Lumber Composite Price

2 U.S. Bureau of Labor Statistics, Consumer Price Index

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.