Quarter in Review

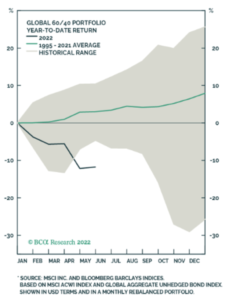

The first quarter of 2022 was extremely challenging for investors, and the second quarter was no better. Indeed, taken together, the first half of 2022 was one of the toughest periods for capital markets on record. The S&P 500 has dropped over 20% since the beginning of the year, the worst first half performance since 1970.1 Bond investors fared little better; the 10.4% decline in the Bloomberg U.S. Aggregate Bond Index was the worst first half since the inception of the index in 1981.2 For investors in traditional 60/40 portfolios, this added up to the worst first half since 1932.3 And while commodities were a bright spot during the first quarter, even those indices posted losses during the second quarter. Below we discuss the factors we believe have been responsible for these historic declines:

Persistent Inflation and Rising Interest Rates Continue to Disrupt Markets

Historically, it has been very unusual for stocks and bonds to both perform so poorly at the same time. In this case, persistent high inflation coupled with rising interest rates have punished both asset classes. Bond prices go down as interest rates rise, and higher inflation and interest rates tend to take a bite out of stock valuations, too. These dynamics only worsened during the second quarter, as higher than expected inflation caused central banks to get more serious about raising interest rates, including a surprise 75 basis point hike from the Federal Reserve Board (Fed) in June, which was the largest interest rate increase from the Fed since 1994.

Slowing Economic Growth Emerges as a New Risk Factor for Investors

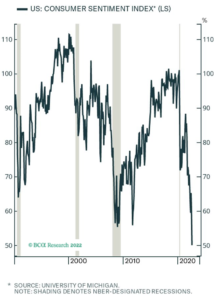

While inflationary pressures and rising interest rates alone would likely have been hard for financial markets to digest, toward the end of the quarter, another “fear factor” arose for investors. There began to be signs of slowing economic growth: June data for consumer sentiment, retail sales, manufacturing activity, housing starts, and other leading indicators showed distinct weakness. Coupled with negative first quarter GDP growth in the U.S., investors started to become jittery about the prospect for a recession sometime this year. This led to a subtle shift in market dynamics. Namely, U.S Treasury bonds, which had sold off meaningfully for most of the first half, began to look more attractive to investors late in the second quarter amid higher yields and rising fears of recession. This makes sense; investors often flee to U.S. Treasuries as a safe haven asset when economic growth slows, usually fleeing riskier assets likes stocks and commodities in the process. Indeed, as the disappointing economic data rolled in, several key stock market indices, including the S&P 500, fell further to end the quarter in bear market territory (defined as a decline of over 20% from the prior peak). Likewise, commodity prices, which had been resilient in the face of inflation and rising interest rates for most of the first half, rolled over and posted losses for the quarter.

The late quarter shift in markets implies that investors have now become increasingly focused on recession risk alongside concerns about a continued inflationary spiral and rising interest rates. This adds slowing economic growth as a key variable to watch as we head into the second half of the year.

Investment Outlook

After a difficult first half of the year, the path forward for the economy and markets remains very uncertain. Inflation remains elevated, and central banks are still expected to aggressively tighten monetary conditions. The key question is, what will be the ultimate impact of these conditions on the economy? On the one hand, it is easy to be pessimistic in the face of a challenging economic backdrop and significant declines in investor portfolios. However, the future picture for investors may not be as bleak as feared since financial markets have already discounted these economic challenges to some degree. While forecasting the future direction of the economy and markets has proven elusive to even the most heralded investors, history can serve as a useful guide to help investors navigate challenging times like these.

Looking to the Past for Guidance

Forecasting market and macroeconomic outcomes is notoriously difficult and unreliable, and it is often more helpful to use history to instruct our outlook and actions. Today, we feel the range of potential outcomes for the economy going forward is unusually wide given the “trilemma” of persistently high inflation, more restrictive monetary policy, and signs of slowing growth.

On the one hand, if inflation begins to moderate and allows central banks to tame their hawkish policy shift, the U.S. economy may only experience a slowdown in growth or a mild recession. History shows that if we experience such an outcome, much of the pain is likely already priced into financial markets. Shallow recessions, such as the 1991 recession, are often preceded by a bear market in equities; however, by the time a recession is confirmed by the data, the bear market is typically already over. This makes even more sense when we consider that the S&P 500 is often looked at as a leading, rather than lagging, indicator for economic growth. Likewise, when bear markets have occurred outside of a recession, markets have rebounded by an average of 14% over the next two quarters.4 If history repeats, even if the U.S. experiences a mild recession sometime in 2022, equity markets could still rebound in the second half of the year.

On the other hand, if high inflation expectations become entrenched among consumers and markets and the Fed is forced to tighten monetary policy more dramatically than is currently discounted, a significant contraction in economic activity and corporate earnings could transpire. Deep recessions, such as that experienced in 2008-2009, are often accompanied by more significant and sustained financial market losses; indeed, S&P 500 bear markets that coincide with recessions have had an average decline of -34.6% over about 15 months.5 If a protracted recession were to occur, investors may need to brace for deeper and longer-lasting declines in their portfolios.

What Is An Investor To Do?

The information above helps to frame possible scenarios for investors, but the difficulty of course occurs when we acknowledge the challenges of predicting an uncertain future for the economy and markets. What, then, can an investor do in the face of so much uncertainty?

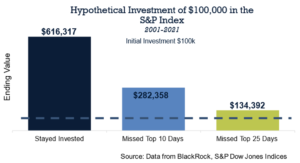

First, don’t try to time the markets. History shows that investors are poor market timers and that trying to sell assets at the peak or buy at the bottom is usually a losing game. History has also shown that gains in positive years for markets have outweighed the drag caused by negative years, allowing long-term, disciplined investors to grow their investments over time.

Second, focus on building resilience in your portfolio. Diversify to account for a wide range of potential outcomes; this means investing across asset classes and considering alternative investments where appropriate. Another way to build resilience is to focus on quality companies with strong balance sheets, steady earnings, and a history of growing their dividends. It may also make sense to incorporate risk mitigation strategies to systematically manage downside risk depending on your time horizon and risk tolerance. These are strategies that can help provide ballast in your portfolio amid volatile market conditions.

Finally, engage with your financial advisor and stay focused on your long-term financial plan. During periods of heightened uncertainty, it is critical to avoid making short-term decisions driven by fear. Investing can be a challenging endeavor that requires enduring temporary pain to reap long-term reward, and your advisor is equipped with the perspective to help you focus on the long run.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.

1 Ned Davis Research, “Nightmare on Asset Allocator Street,” July 1, 2022

2 Ibid.

3 Ibid.

4 ClearBridge Investments, “Anatomy of a Recession,” July 7, 2022

5 Ned Davis Research, “Jay Powell and the Three Bears”, July 6, 2022