Quarter in Review

Stock Markets Continue Rising Amid Resilient Economy and Moderating Inflation

Stock market indices continued to rally in the second quarter as U.S. economic activity has proved surprisingly resilient and inflationary pressures have meaningfully moderated. This marks the third consecutive quarter of gains for equity investors, and stock market indices have now rebounded significantly from their October 2022 lows after last year’s sharp sell-off. The first half of 2023 was particularly favorable for the higher growth technology stocks that struggled last year, with the NASDAQ Index producing its strongest first-half results in forty years. The old investment adage of being greedy when others are fearful has seemingly proven its merit yet again.

Resilient Economic Activity

The year began with many investors and economists warning of an elevated risk of recession due to the pronounced tightening in monetary policy being orchestrated by central banks to combat inflation. This was based on the widely held belief that the sharp rise in interest rates from the Federal Reserve and other central banks would cause a meaningful slowdown in economic activity in 2023. Through the first half of the year, the economy has proven more resilient than investors and economists had predicted, and there are few signs that recession is imminent based on current economic data.

- The job market remains strong with steady gains in employment and historically high job openings relative to the number of unemployed workers.

- Consumers are spending as demand for services continues to grow, and households maintain significant excess savings accumulated during the pandemic to help fund increased spending.

- The housing market has been surprisingly resilient despite the sharp rise in mortgage rates as housing inventories remain low and demand for homes continues to outpace available supply.

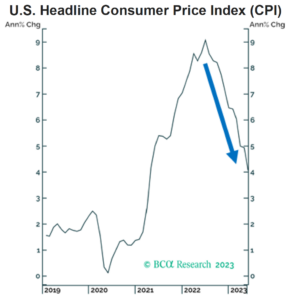

Moderating Inflationary Pressures

INVESTMENT OUTLOOK

Can the Federal Reserve Deliver a Historically Elusive Soft Landing?

Most investors and economists entered 2023 anticipating a slowdown in economic activity due to the historic pace and magnitude of monetary policy tightening being orchestrated by the Federal Reserve and other central banks around the world to combat inflation. Past monetary tightening cycles of this scale have reliably led to recession as central banks have significantly tightened financial conditions to slow demand and cool inflation through higher interest rates and reduced liquidity. Not surprisingly, several leading economic indicators have been flashing red for much of 2023, including an inverted yield curve, persistent monthly declines in the Conference Board Leading Economic Index®, more restrictive lending conditions from banks, and a slowdown in global manufacturing activity.

Despite these concerns, the economy has been resilient, with few measures of current activity signaling recession is imminent. Many investors have begun to wonder if the Federal Reserve has successfully engineered a historically elusive soft landing – tightening financial conditions enough to cool inflation but not so much to tip the economy into recession.

Could This Time Be Different?

While we believe a recession will ultimately ensue from the effects of tighter monetary policy based on historical precedent, the timing remains highly uncertain. On the one hand, current economic activity remains surprisingly robust by most measures, and inflation is steadily moderating, suggesting the Federal Reserve may be nearing the end of its tightening campaign. On the other hand, leading economic indicators are signaling the risk of recession is historically high, and inflation remains well above central bank target levels, suggesting restrictive financial conditions may still be with us for some time. Further complicating matters for investors, many key economic indicators have been distorted by pandemic effects in recent years leaving them more unpredictable and potentially less reliable in the current economic cycle. Lastly, investors have grown increasingly optimistic of late with strong gains and reduced volatility in stock markets, which suggests a lot of the good news may be priced into markets.

PERSPECTIVE FOR INVESTORS

We encourage investors to stay disciplined and maintain a long-term perspective amid heightened uncertainty in the economic outlook. Investing is an endeavor defined by uncertainty as financial markets attempt to price what investors believe is most likely to transpire in an unpredictable future.

We continue to advocate a focus on the following:

- staying diversified;

- focusing on resilience in portfolios;

- communicating proactively with your financial advisor as your financial situation changes

As always, we will be closely monitoring economic and financial market data for clearer signals on the path forward for the economy and markets and will continue to dynamically manage the portfolios under our care accordingly.

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor. This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.