Third Quarter in Review

Stock and bond markets were relatively flat during 3Q21 with the S&P 500 up less than 1% and the Bloomberg U.S. Aggregate Bond Index unchanged for the quarter. International equity markets, as measured by the MSCI EAFE Index, were down less than 1%. However, the end of quarter results did not tell the full story: the S&P 500 reached an all-time high in early September before declining 5% during the month amid concerns about slowing economic growth and rising inflationary pressures. The bond market mirrored the stock market during the quarter: declining interest rates led to higher bond prices during the early part of the quarter, but these price gains were undone as interest rates rose and bond prices declined in September due to consternation about rising inflation and expectations for the Federal Reserve to begin tapering its asset purchases.

Despite the recent volatility in September, this year continues to be a strong one for stock markets with the S&P 500 up 15.9% through the end of 3Q21. Key trends in the quarter included:

- Strong Corporate Earnings: A snap back in corporate earnings provided support for the equity market during the early portion of 3Q21. Annual S&P 500 earnings growth was 91% in 2Q21, which is the highest year-over-year growth rate since 4Q09.

- Risks to Future Growth: A few factors developed during the quarter that may hamper economic growth and likely contributed to the pull-back in equity markets during September. The Delta variant drove a spike in COVID cases that led to a slowdown in the reopening of the global economy. Also, supply bottlenecks intensified – you may have seen images of the record number of cargo ships anchored off the coast of California waiting to unload. These bottlenecks are playing out across numerous industries, resulting in product shortages and price increases. Car manufacturers have been struggling to source parts, such as semiconductors, which has led to a shortage of new vehicles and significant increases in used car prices. Energy prices also rose sharply as supply struggled to keep pace with rising demand in response to the economic reopening. Internationally, China struggled as economic growth slowed and markets were beset by increased government regulation of key industries and the likely default of the country’s second-largest property developer, Evergrande.

- Fed Policy Shift: Since June 2020, the Federal Reserve has been buying $120 billion of securities a month to help support the economy and enhance market liquidity. These actions have likely contributed to the historically low current interest rates. Federal Reserve Chairman Jerome Powell indicated that the central bank will likely announce a tapering of its bond purchase program at its next meeting in November. This is expected to be the first step of normalizing monetary policy after the unprecedented actions taken during 2020.

Investment Outlook

We believe the U.S. and global economies are entering a period of transition where growth will slow from the torrid pace earlier this year and the substantial fiscal and monetary support provided since March 2020 will slowly be removed. However, slowing economic growth is not the same as the declining growth associated with recession. To put the expected slowdown in perspective, the U.S. economy grew, as measured by GDP, 6.7% on an annualized basis in 2Q21; the Conference Board forecast for 2022 is currently 3.8%, which is still above the average annual GDP growth of 2.3% from 2010-2019. We believe the following factors will be key in determining the path forward for the economy:

- Resilience of Corporate Earnings: For 3Q21, the estimated earnings growth rate for the S&P 500 is 28% year over-year (FactSet). While less than the growth in 2Q21, this would represent the third-highest annual earnings growth rate reported by the index since 2010. The commentary from management teams during the quarterly earnings conference calls regarding the outlook for their businesses will also be crucial.

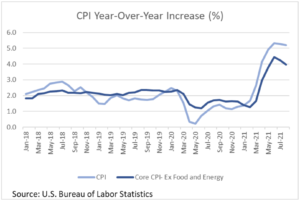

- Pace of Inflation: Fed Chairman Powell recently stated the combination of strong demand for goods and bottlenecks in supply chains has meant that inflation is currently running well above the Fed’s target. The timing for the supply bottlenecks to be resolved will likely vary by industry. For example, lumber supply has improved significantly since the first of the year and lumber prices are down sharply. Other sectors, such as semiconductors, may take a year or more to add additional capacity to meet demand. The Fed expects the supply constraints will be temporary and ultimately improve, which should result in inflation declining from current elevated levels. However, there is the risk that if inflationary pressures continue for longer than expected, the Fed may need to take more aggressive action to tighten monetary policy than is currently anticipated by the markets.

- Political Uncertainty: U.S. equity markets experienced volatility in late September and early October due in part to the debate about the debt ceiling. The U.S. Treasury Department had forecasted the debt ceiling would be reached on October 18th, and a short-term agreement for raising the debt ceiling was ultimately reached. This is not the first time the U.S. has dealt with this issue in recent years, and Congress will likely be facing the same debt ceiling debate in early December, when the current short-term agreement expires. Given the dire consequences of not raising the debt limit, we expect the limit to ultimately be raised again in December or suspended. However, the political brinkmanship associated with the debt ceiling alongside uncertainty regarding the President Biden’s 2022 proposed budget, which may result in tax increases for some individuals and corporations, as well as continued debate over the passage of a bipartisan infrastructure bill could further pressure markets in the coming months.

Closing Thoughts

Overall, our market outlook remains constructive. The global economy is expected to continue growing at an above-trend pace, consumer balance sheets are strong, and central bank policy remains accommodative. However, we will be closely monitoring potential risks investors may face, including the resilience of corporate earnings, rising inflation, and political uncertainty, as the global economy is expected to transition to a slower, and hopefully more sustainable, pace of growth over the coming quarters.

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.