Quarter in Review

Despite a Promising Start, Markets Ultimately Resumed Their Decline & Reached New Lows in Q3

After a historically challenging first half of 2022 for financial markets, investors had a reprieve in the early weeks of the third quarter with the S&P 500 rallying 17% from June 16 to August 16. However, the reprieve for investors proved fleeting as stubbornly high inflation data in the U.S. and internationally prompted increasingly hawkish rhetoric and monetary policy actions from central banks around the world, led by the U.S. Federal Reserve. In response, stock and bond markets declined sharply from mid-August through the end of September and reached new lows for the year.

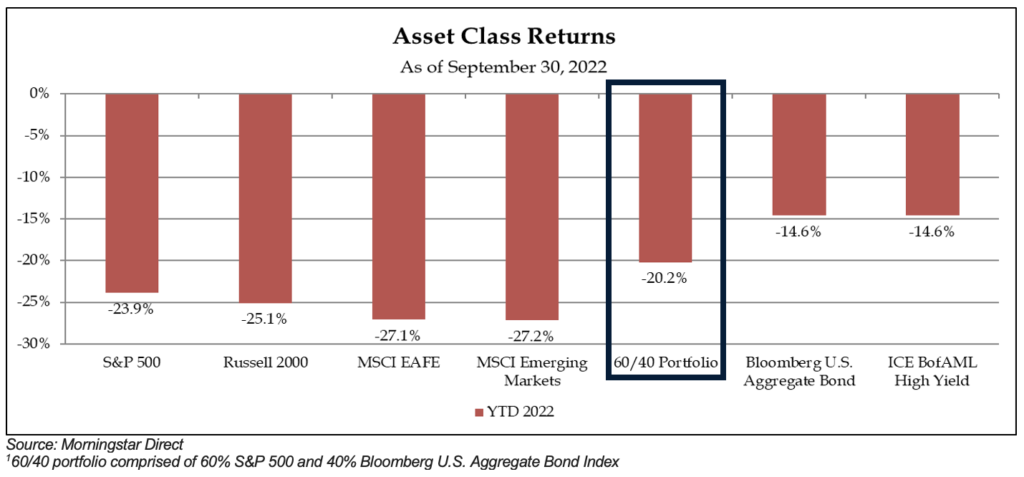

For balanced investors, the first nine months of 2022 has proven the most challenging period since 1974 with the time- tested 60/40 portfolio1 declining by 20% so far this year (Ned Davis Research). What has made 2022 such a challenging year for financial markets is that there has been nowhere for investors to hide with most major stock and bond market indices suffering double-digit declines, as detailed in the chart below.

We believe the proximate cause of the ongoing turmoil across global financial markets remains the perplexing trilemma of factors we wrote about last quarter:

- Stubbornly high consumer price inflation

- Hawkish central banks aggressively raising interest rates

- Slowing global economic growth due to rapidly tightening financial conditions

These challenging dynamics remain firmly entrenched today and are likely to be a source of continued uncertainty and volatility in financial markets for the foreseeable future.

Investment Outlook

Will the Economy Follow Financial Markets into the Doldrums?

Unsurprisingly, pessimism has taken hold among investors, and increasingly consumers, with most believing we are already in recession. While economic growth has slowed markedly from the elevated levels of 2021, U.S. economic activity has yet to meaningfully contract. We believe the economic outlook is more nuanced than the broad-based pessimism suggests.

On the one hand, while the economic backdrop is not rosy, the U.S. economy has remained resilient so far:

- The labor market remains strong with continued job growth, plentiful job openings, and low levels of unemployment

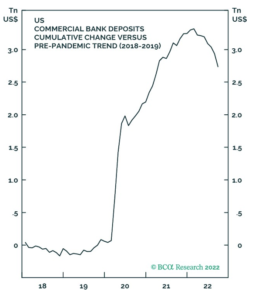

- U.S. consumers, in aggregate, are in a relatively strong financial position with healthy balance sheets and elevated savings accumulated during the pandemic

On the other hand, the economy is still facing a myriad of challenges that have resulted in heightened uncertainty regarding the outlook for economic activity going forward:

- The aggressive tightening of monetary conditions by central banks will likely provide increasingly strong headwinds for the economy

- Inflation levels remain stubbornly elevated, and increasingly “sticky”, which will continue to present challenges for consumers and businesses

- The sharp rise in interest rates is beginning to negatively impact the housing market (see below)

- Key international economies, especially Europe and China, are struggling

Key Factors to Watch

The economic outlook is fraught with uncertainty. We are in the midst of one of the most significant periods of monetary policy tightening in decades; historically, central bank actions have impacted the economy with a long and variable lag, signaling an increased risk for unintended consequences. Going forward, we will be closely monitoring inflation and corporate earnings.

While current inflation rates remain stubbornly high, future inflation expectations from markets and consumers remain contained. Further, there are signs current inflation rates may be peaking amid easing supply chain pressures and recent declines in commodity prices.

Corporate earnings have remained surprisingly resilient and are still expected to grow over the next year. The trajectory of earnings is likely the most important factor for markets in the coming quarters.

Perspective For Investors

What Is an Investor to Do in the Face of Such Uncertainty?

Times like these are trying for investors as financial markets are in turmoil and pessimism has gained the upper hand. However, it is during volatile periods for financial markets that maintaining a long-term investment perspective and staying focused on a long-term financial plan are most important.

Maintain Discipline

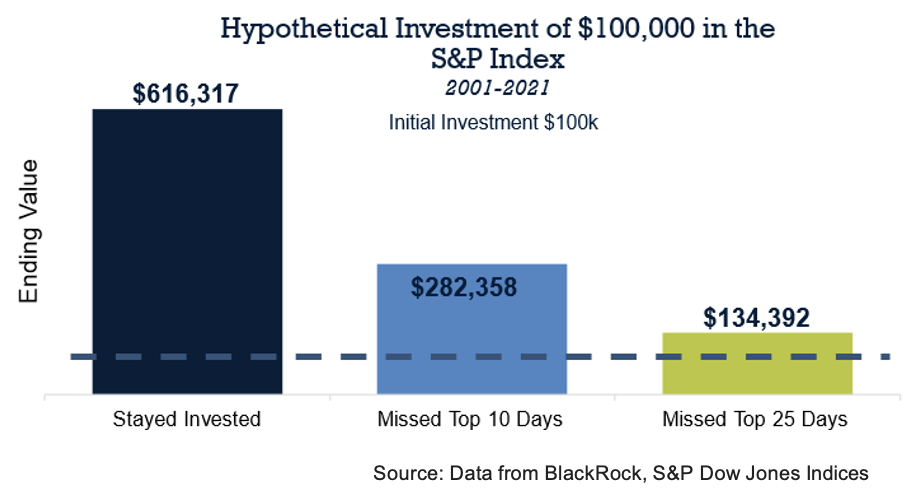

First, don’t try to time the markets. History shows that investors are poor market timers; trying to sell assets at the peak or buy at the bottom is usually a losing game. History has also shown that some of the strongest gains for financial markets have come after periods of intense pain, like investors are experiencing this year. Missing these market recoveries can have an outsized impact on the long-term growth of investor portfolios.

Focus on Resilience

While we do not promote attempting to time markets, we do believe there are actions investors can take to increase resilience in their portfolios during turbulent times. First and foremost, diversify to account for a wide range of potential outcomes; this means investing across asset classes and considering alternative investments where appropriate.

Second, emphasize quality companies with strong balance sheets, steady earnings, and a history of growing their dividends. Finally, consider incorporating dynamic risk mitigation strategies to systematically and unemotionally manage downside risk depending on your time horizon and risk tolerance.

Finally, engage with your financial advisor and stay focused on your long-term financial plan. During periods of heightened uncertainty, it is critical to avoid making short-term decisions driven by fear. Investing can be a challenging endeavor that requires enduring temporary pain to reap long-term reward, and your advisor is equipped with the perspective to help you focus on the long run.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Investors should consult their financial, tax, and legal advisors before making investment decisions. Past performance results are no indication of future returns, and all investments may result in loss of principal.