Market Review & Outlook

Despite some turbulence, U.S. equity markets extended their strong gains during Q3 and finished the quarter near record highs.

The S&P 500 rose by 5.9% in Q3 and extended its gains to 22% through the first nine months of the year. Although equity markets finished on a strong note, there was a sharp pullback in stock prices earlier in the quarter due to concerns about a weakening U.S. labor market and volatility around the unwind of the Japanese yen carry trade. This pullback was short lived as the U.S. economy once again proved more resilient than feared and the Federal Reserve (Fed) delivered on a widely anticipated interest rate cut.

There was a notable broadening in equity markets during Q3, which was a welcome development for investors after the very narrow gains in Q2. U.S. small cap and international stock market indices outperformed their U.S. large cap counterparts for the first time in a while in Q3. This was a sharp reversal from the Q2 results where a small group of dominant U.S. technology stocks, popularly referred to as the Magnificent 7, saw strong gains while most stocks in U.S. and international markets struggled. Of note, international equity markets benefited from a recently announced package of stimulus measures from the Chinese government that pushed Chinese stock prices sharply higher at the end of the quarter. Investors generally view the recent broadening of market gains as a bullish signal that has the potential to extend the current equity bull market.

Bonds finally joined the rally as fixed income markets posted strong gains in Q3 in response to a sharp decline in interest rates.

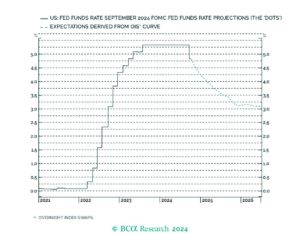

After posting lackluster results in the first half of the year, bond markets, as measured by the Bloomberg U.S. Aggregate Bond index, posted a 5.2% gain in the third quarter. Bond markets responded to declining interest rates as inflation pressures continued to abate and most major central banks embarked on a long-awaited easing of monetary policy by cutting interest rates. Most notably, the Fed began its much-anticipated easing cycle with an outsized 50-basis point cut to the federal funds rate in September in conjunction with clear communication that they expect to cut rates several more times over the balance of this year and next year.

INVESTMENT OUTLOOK

The Fed takes center stage (again) as it embarks on its widely anticipated cycle of interest rate cuts seeking to bring monetary policy to a more balanced posture.

After a multi-year period of rapidly increasing and then maintaining interest rates at elevated levels to combat inflation, the Fed reduced the federal funds rate by an outsized 50-basis points in September. More importantly for investors, the Fed strongly signaled that this was the first of what they expect to be several interest rate cuts over the remainder of this year and next year to bring monetary policy to a more balanced level. This proved a strong catalyst for stock and bond markets as lower interest rates coupled with a resilient economy fueled broad-based gains in financial markets.

Has the Fed successfully engineered a historically elusive soft landing for the economy?

The predictions of recession that had dominated the financial headlines in 2023 have all but vanished in 2024. With inflation sharply decelerating and rapidly approaching the Fed’s 2% target level and U.S. economic growth remaining robust, the current evidence points to a high likelihood of a soft landing, which should remain supportive of financial markets in the near term. However, risks remain on the horizon as the ultimate impact of the recent inflationary spike and subsequent sharp tightening in monetary policy engineered by global central banks has likely not yet made its full impact on the economy while financial markets are currently facing elevated geopolitical uncertainty.

What potential risks are on the horizon?

- While U.S. economic growth remains resilient, there are some signs of cooling in the labor market with the unemployment rate rising (albeit from very low levels) and the number of job openings declining (albeit from elevated levels). Of note, the Fed stated that they are now just as focused on the full employment side of their mandate as they are the stable price side of their mandate.

- While there is currently broad-based consensus that the inflation battle is nearly over, an unexpected reacceleration of inflation would likely prove highly disruptive to financial markets with the scars from the recent bout of inflation still seared into the minds of consumers and investors. While seemingly now a lower probability risk, it has the potential to materially alter the Fed’s plans and would likely lead to a sharp repricing of interest rates and asset prices akin to 2022.

- Elevated geopolitical risk due to an expanding war in the Middle East and the upcoming U.S. presidential election coupled with equity markets, especially in the U.S., trading at historically expensive valuations by most measures leaves financial markets vulnerable on the downside to unexpected events.

PERSPECTIVE FOR INVESTORS

The current momentum in the economy and financial markets seems likely to continue in the near term amid resilient economic growth that will likely be further supported by easing monetary policy as inflationary pressures continue to wane. That said, the future remains unknowable, and it is important for investors to remain disciplined and to stay diversified in their investment portfolios to prepare for potential risks. Attempting to time markets has generally proven a fool’s errand historically and we believe it remains so today. As always, we encourage investors to remain engaged with their financial advisors and to make their financial plans living plans.

Discover more from the FCMS Investment Committee by subscribing to our Founders Insights blog and following us on LinkedIn.

Authored by the Freedom Capital Management Strategies® Investment Team | October 2024

Securities and Investment Advisory Services offered through Founders Financial Securities, LLC. Member FINRA, SIPC and Registered Investment Advisor.

This material contains the opinions of the author(s) but not necessarily those of Founders Financial Securities, LLC and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. Past performance does not guarantee future results.